- The Middle Eastern war has put the dollar back in the spotlight as markets seek safety. Meanwhile, the American economic slowdown may have already ended, with labor market data now questioning the Federal Reserve’s expected rate cuts.

- Inflation has dropped below 2% in Europe, and the European Central Bank (ECB) is expected to implement even more aggressive rate cuts, given the ongoing economic slowdown. However, the risk of inflation re-accelerating due to geopolitical tensions remains.

- The EUR/USD has struggled to break the 1.12 resistance level and is now approaching 1.10. A potential double top is forming.

Geopolitical Tensions Lift Oil Prices, Strong U.S. Jobs Data Challenges Fed Rate Cuts

Markets remain tense amid the wave of Middle Eastern war tensions. Israel’s attack on Lebanon and Iran’s retaliatory response on Israeli soil threaten to expand the conflict. However, markets have found some comfort in China’s decisive actions to combat the stagnation of its economy through significant monetary and fiscal policies.

As expected, oil prices have surged above $70 per barrel, and the dollar has strengthened, moving away from critical resistance levels in the EUR/USD exchange rate.

The first week of the month is always pivotal for U.S. macroeconomic data, as the employment numbers are released. The data has shown that the U.S. economy is far from a downturn. With the creation of 254,000 new jobs, unemployment dropping to 4.1%, and an annual wage increase of 4%, the notion of an aggressive Fed cutting rates has been challenged.

These unemployment numbers play a significant role in the lead-up to the Federal Open Market Committee (FOMC) meeting on November 7, where another rate cut may take shape. Still, Federal Reserve Chair Powell has signaled that further developments in the data must be closely monitored.

Meanwhile, the ISM manufacturing index, in contrast to the strong payroll figures, confirmed a slowdown, falling below 50. Although mixed readings were seen across subcomponents, with prices below 50, employment down, and new orders on the rise, the data paints a complex picture.

In Europe, inflation continues to decline, dipping below 2%. Preliminary September data showed a cooling to 1.8% year-over-year, down from 2.2% in August. Core inflation also retreated to 2.7%. These are the lowest levels since June 2021, with some countries, like Italy, seeing price growth close to zero. This raises the likelihood of a 50 basis point cut in the ECB’s next monetary policy meeting.

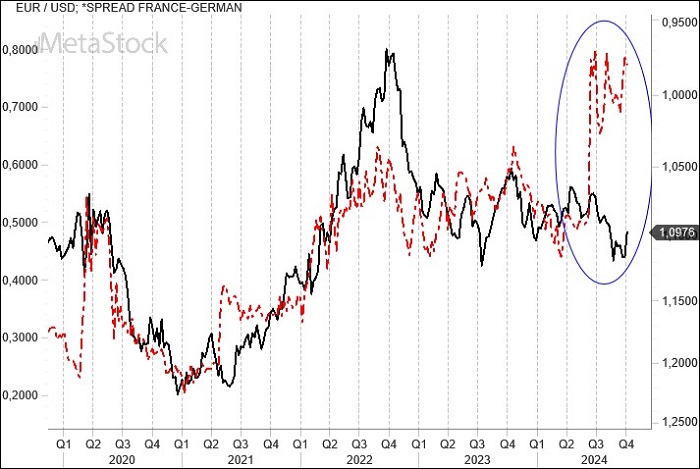

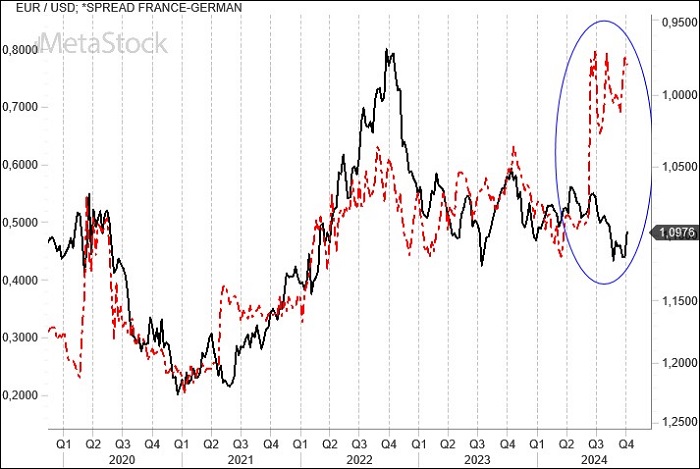

Technical Analysis: Key EUR/USD Levels Face Pressure Amid France-Germany Bond Spread Divergence

Following the appointment of Barnier as prime minister, France is working to define its fiscal framework for the coming years. A complex situation is emerging, with inevitable tax hikes for both individuals and businesses. Barnier aims to bring the deficit-to-GDP ratio, currently over 6%, down to 3% within the next two years.

The spread between French and German bonds remains at its highest in recent months, creating an intriguing divergence for markets with the EUR/USD. Either French bonds (OATs) are currently undervalued, or the euro is due for a significant drop. It’s a situation that requires close monitoring.

There’s little doubt about the strategic importance of the 1.12 resistance level for the EUR/USD. Between August and September, the euro made two attempts to break through this critical level, which even the Fed’s 50 basis point rate cut couldn’t shake.

Equally critical now are the support levels around 1.10. This area represents the pivot of a potential double top formation and marks the passing of the uptrend line that has guided the euro’s rally since July. Friday’s close cast doubt on whether this level will hold.

Breaking through the 1.10 level, as attempted on Friday following the unemployment data, would effectively confirm a double top formation, potentially pushing the exchange rate down to 1.08 and bringing back into play the long-standing trading range that had seemed to be left behind.

Leave a Reply

You must be logged in to post a comment.