-

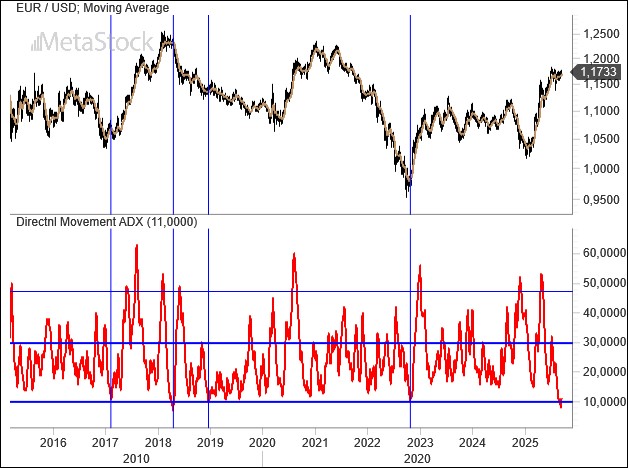

EUR/USD Weekly Outlook, January 5, 2026: Is Another Year of Dollar Weakness Ahead?

With an especially negative 2025 now behind it, the U.S. dollar is beginning to face the first 2026 outlooks from major investment houses, many of which highlight a series of challenging factors ahead for the greenback. Beyond pure price-based technical analysis, pivotal events such as the U.S. midterm elections and a change in leadership at…

-

EUR/USD Weekly Outlook, December 22: The World According to Trump

The U.S. economy failed to generate jobs in the past quarter, a consequence of the government shutdown and, likely, of consumers becoming more cautious as inflation struggles to ease. Trump has sought to reassure the country by placing confidence in the future Federal Reserve chair, who is expected to lower interest rates. The dollar, meanwhile,…

-

EUR/USD Weekly Outlook, December 15: Geopolitics Back in the Driver’s Seat

The Federal Reserve cut rates by 25 basis points as expected, bringing them into the 3.5%–3.75% range, while striking a cautious tone on its next moves. At the same time, tensions are rising between President Trump and European leaders over Ukraine, with the tycoon increasingly aligned with Russian positions and eager to seal a deal…

-

EUR/USD Weekly Outlook, December 8: Markets Edge Higher as Fed Cut Looms

Markets are entering the Federal Reserve meeting with only modest volatility, given an outcome that appears all but certain. What remains unclear is whether December’s rate cut will be followed by additional easing moves, especially with macro data that doesn’t seem to justify further intervention. In the meantime, the dollar continues to lose ground, slipping…

-

Weekly EUR/USD Outlook, December 1: The Dollar Enters Its Toughest Month

America heads into Thanksgiving with inflation appearing to cool, but also with a labor market showing signs of uncertainty. That combination is likely to push the Federal Reserve toward a rate cut on December 10, just as the race to succeed Powell begins. For EUR/USD, December is shaping up to be one of the strongest…

-

EUR/USD Weekly Outlook – November 24, 2025: Black Friday Gives the Dollar a Boost

It was a positive week for the dollar, which regained ground as macroeconomic data slowly returned following the shutdown freeze. The labor-market figures were the most anticipated among the releases, arriving just as the race to replace Powell officially begins. Five candidates are now expected to be in contention for the role of the next…

-

EUR/USD Weekly Outlook – November 17, 2025: Shutdown Ends, but at What Cost?

The longest shutdown in U.S. history has come to an end after Congress approved a temporary plan to lift the debt ceiling through January, leaving behind an inevitable economic slowdown that has done little to unsettle equity or currency markets. The situation adds uncertainty to how the Federal Reserve will act before year-end. EUR/USD has…

-

EUR/USD Weekly Outlook, November 10 2025: The Dollar Benefits from Uncertainty

The longest shutdown in U.S. history has unfolded amid uncertainty surrounding the Supreme Court’s pending ruling on tariffs and an unexpectedly hawkish turn in U.S. interest rate expectations following comments from Fed Chair Powell. As a result, the dollar regained ground, pushing EUR/USD back below 1.15. With key macro data and futures market positioning still…

-

EUR/USD Weekly Outlook – November 3, 2025: Rates Fall as China Moves Closer

Trump’s Asian Tour Brings Renewed Momentum Donald Trump’s Asian tour underscores the growing importance of Pacific alliances, strengthening ties with Japan and South Korea—two nations that had clashed with Washington over tariffs in recent months. The trip also highlights Trump’s intent to reach an agreement with China, marked by his meeting with President Xi and…

-

EUR/USD Weekly Outlook, October 20, 2025: Middle East, the Fed, France, the Shutdown, and China

Markets Bet on Fed Easing As Trump celebrates a fragile peace deal between Israel and Hamas, expected to bring temporary calm to Gaza, he is also seeking to broker an eventual truce between Russia and Ukraine. Meanwhile, markets appear oddly comfortable with the U.S. government shutdown that has been in place since October 1, which…

-

EUR/USD Weekly Outlook, September 29 2025: Dollar Struggles on Fed Caution, Geopolitical Risks

The currency market remains stuck. After its recent rate cut, the Fed is preaching caution, citing inflation risks and tariff pressures. The White House, meanwhile, is loudly pushing for lower borrowing costs while reigniting the trade tariff debate. In Europe, growth is stagnant, and the possibility of an escalation with Russia can no longer be…

-

Weekly EUR/USD Outlook – September 15, 2025: War in Europe and Fed Rate Cuts

Tensions are rising along Europe’s eastern borders after Russia’s incursion into Poland. The situation has boosted safe-haven assets such as gold and temporarily halted the dollar’s slide, though the greenback remains close to critical levels against the euro. In France, the government has collapsed, and President Emmanuel Macron is making another attempt by handing the…