-

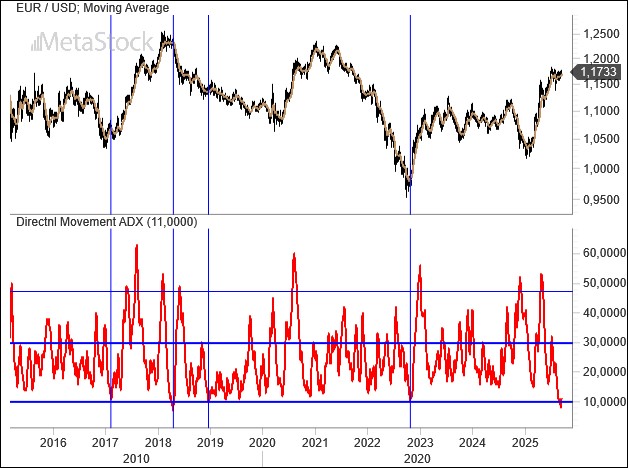

EUR/USD Weekly Outlook, November 10 2025: The Dollar Benefits from Uncertainty

The longest shutdown in U.S. history has unfolded amid uncertainty surrounding the Supreme Court’s pending ruling on tariffs and an unexpectedly hawkish turn in U.S. interest rate expectations following comments from Fed Chair Powell. As a result, the dollar regained ground, pushing EUR/USD back below 1.15. With key macro data and futures market positioning still…

-

EUR/USD Weekly Outlook – November 3, 2025: Rates Fall as China Moves Closer

Trump’s Asian Tour Brings Renewed Momentum Donald Trump’s Asian tour underscores the growing importance of Pacific alliances, strengthening ties with Japan and South Korea—two nations that had clashed with Washington over tariffs in recent months. The trip also highlights Trump’s intent to reach an agreement with China, marked by his meeting with President Xi and…

-

EUR/USD Weekly Outlook, October 20, 2025: Middle East, the Fed, France, the Shutdown, and China

Markets Bet on Fed Easing As Trump celebrates a fragile peace deal between Israel and Hamas, expected to bring temporary calm to Gaza, he is also seeking to broker an eventual truce between Russia and Ukraine. Meanwhile, markets appear oddly comfortable with the U.S. government shutdown that has been in place since October 1, which…

-

EUR/USD Weekly Outlook, September 29 2025: Dollar Struggles on Fed Caution, Geopolitical Risks

The currency market remains stuck. After its recent rate cut, the Fed is preaching caution, citing inflation risks and tariff pressures. The White House, meanwhile, is loudly pushing for lower borrowing costs while reigniting the trade tariff debate. In Europe, growth is stagnant, and the possibility of an escalation with Russia can no longer be…

-

Weekly EUR/USD Outlook – September 15, 2025: War in Europe and Fed Rate Cuts

Tensions are rising along Europe’s eastern borders after Russia’s incursion into Poland. The situation has boosted safe-haven assets such as gold and temporarily halted the dollar’s slide, though the greenback remains close to critical levels against the euro. In France, the government has collapsed, and President Emmanuel Macron is making another attempt by handing the…

-

Weekly EUR/USD Outlook, September 8, 2025: Powell to Cut Rates

U.S. Jobs Market Hits a Wall The week’s pivotal release came from the U.S. labor market—and it disappointed. Just over 20,000 new jobs were created, while the unemployment rate climbed to its highest since late 2021. The White House, eager for evidence of a slowdown driven by high rates, found just that. With tariffs largely…

-

Weekly EUR/USD Outlook, September 1, 2025: Fed Pressure and France’s Political Turmoil Shape the Trend

Trump Pressures the Fed as France’s Crisis Lifts Dollar After Powell’s dovish signals at Jackson Hole, the White House stepped up its confrontation with the Fed, demanding Governor Cook’s removal on allegations of fraud. Whether or not the accusations hold, Donald Trump’s not-so-subtle effort to steer monetary policy toward a looser stance is becoming increasingly…

-

EUR/USD Weekly Outlook, August 14, 2025: Tariffs and a Weak Dollar, the Story Continues

Trump is keeping tariff tensions high, with India becoming the latest target of a renewed 50% hike following Brazil. Europe, for now, appears to be out of the immediate line of fire, though the threat of further escalation—should trade agreements not be honored—remains, with pharmaceutical products still under the constant shadow of potential tariffs. After…

-

Weekly EUR/USD Outlook, August 4, 2025 – Euro Pulls Back as Tariffs Rise and Fed Holds Rates

The trade war enters a new phase with agreements reached with the EU and Japan, but fresh tensions flare toward Canada, India, Brazil, and Switzerland. The tycoon seized on the disappointing jobs report to pressure Powell into delivering a rate cut. After testing key support levels, EUR/USD is once again moving higher.

-

Weekly EUR/USD Outlook, July 28, 2025 – Dollar Under Pressure as Tariff Deals Advance and ECB Holds the Line

Tariff Deals Take Shape as Trump Targets Powell and ECB Signals Pause Recent developments on the tariff front suggest the White House is serious about securing definitive trade deals before summer’s end. Japan has now agreed to Washington’s demands for a more balanced trade relationship, accepting a 15% tariff on exports to the U.S. and…

-

Weekly EUR/USD Outlook, July 14, 2025: Trade Tensions Resurface as 1.20 Comes into View

The trade war returns to center stage. With the suspension window now closed, the White House has begun sending letters to every country that failed to agree to its proposed trade deals. Nations like Brazil now face tariffs of 50%, Japan 25%, and Canada 35%. In response, the Fed is taking a cautious stance on…

-

Weekly EUR/USD Outlook, July 7 2025: Trump-Powell Rift Deepens as Euro Targets 1.20

The trade war may be dormant, but it’s far from over—and in the meantime, a war of words is heating up in the U.S. between Trump and Powell. The latter, aware of the need to ease borrowing costs for the American economy, stated that interest rates would already be lower if tariffs weren’t in place.…