Category: General

-

Weekly EUR/USD Outlook for October 7, 2024 – Middle Eastern Conflict Bolsters Dollar as Inflation Declines in Europe

Geopolitical Tensions Lift Oil Prices, Strong U.S. Jobs Data Challenges Fed Rate Cuts Markets remain tense amid the wave of Middle Eastern war tensions. Israel’s attack on Lebanon and Iran’s retaliatory response on Israeli soil threaten to expand the conflict. However, markets have found some comfort in China’s decisive actions to combat the stagnation of…

-

Weekly Eur/Usd Outlook for September 30, 2024 – Euro Holds as U.S. Rate Cuts Loom

Global bond yields continue to compress, signaling that markets expect more accommodative policies from central banks. While Europe seems headed for recession, China is reviving its monetary and fiscal tools in an effort to escape an increasingly entrenched deflationary crisis.

-

Weekly EUR/USD Outlook – September 23, 2024 – Fed’s Surprise Rate Cut

Fed’s Aggressive Rate Cuts Spark Debate as Economic Uncertainty Grows In alignment with bond market expectations, the Fed acted swiftly with a substantial 50 basis point rate cut, possibly aiming to make up for lost ground in August. The market now anticipates two additional 25 basis point cuts in the year’s final two meetings, scheduled…

-

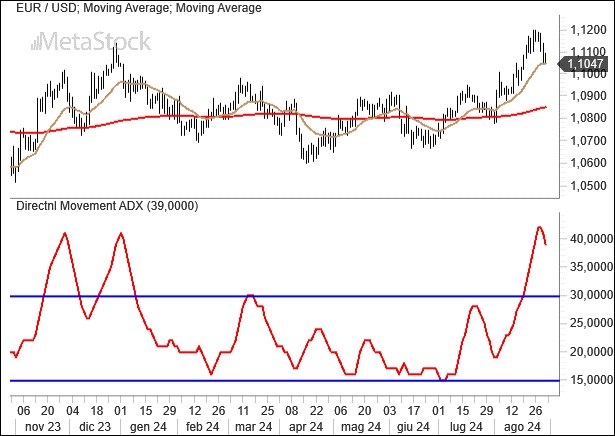

Weekly EurUsd Outlook for September 16, 2024 – Central Banks Take the Stage Amid Key Resistance Levels

The dollar holds steady, and the euro fails to advance. This sums up a week in which the ECB fulfilled its promise to cut interest rates, while U.S. inflation, at 2.5%, set the stage for a similar move by the Fed in what will be the final meeting before the much-anticipated presidential elections in November.

-

EurUsd Weekly Outlook – September 9, 2024: Markets Brace for Fed and ECB Decisions

The dollar continues to remain weak ahead of the two central bank meetings (FED and ECB), which are expected to result in a new rate cut from the ECB and the start of an expansionary phase by the FED. The dollar is losing ground due to the prospect of a more decisive U.S. monetary policy…

-

Weekly EurUsd Outlook for September 2, 2024 – Dollar Resilience Amid Fed Rate Cut Expectations

The resilience of the dollar seems to be the dominant theme as August comes to a close, with the Fed making it clear that rate cuts will occur before the November presidential elections. The greenback has held its ground, avoiding a breach of key technical levels against both the euro and the yen. Meanwhile, in…

-

Weekly EurUsd Outlook for July 22, 2024 – Fed & ECB Rate Cuts on the Horizon, Biden Withdraws

Biden has decided to step back from the presidential race, and this event, following the attack on Donald Trump, further fuels uncertainty about the outcome of the November election. Meanwhile, the market is convinced of a Fed Funds rate cut in September. The ECB remains on standby, announcing a possible move in September if inflation…

-

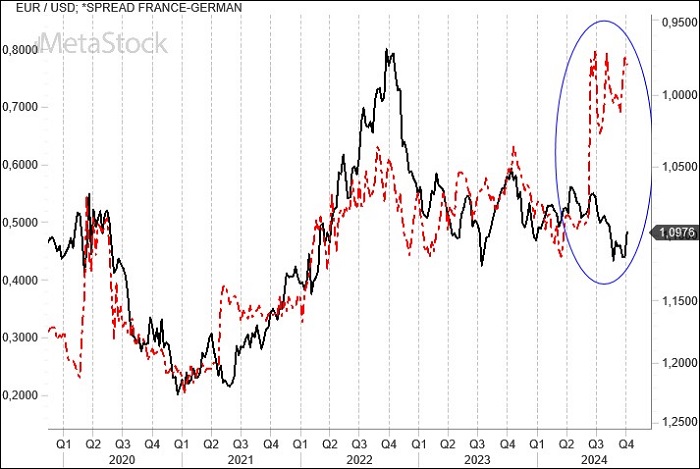

Weekly EurUsd Outlook July 8, 2024 – French Vote Shakes Markets

The French elections seem to have almost benefited the euro, which had dangerously approached critical support levels. The prospect of political stagnation combined with uncertainties on the American electoral front, as well as a certain stand-by on interest rates, help to keep the trading range on EurUsd active.

-

Weekly EurUsd Outlook for June 3, 2024 – Favorable Euro Window Amidst Inflation Concerns

ECB Rate Decision Nears Amid Rising European Inflation The ECB’s rate decision is approaching, and the preliminary inflation data for May is crucial for understanding whether Frankfurt will act in this direction or be swayed by some conflicting signals that have emerged in recent days. Inflation is indeed rising in Germany, according to preliminary May…

-

Weekly EUR/USD Outlook for May 20, 2024 – Inflation Weighs on the Dollar

U.S. Inflation Moderates, Boosting Euro Against Dollar Inflation is aiding the euro, which is approaching resistance levels that, if breached, could trigger a rally for the single currency. We’ll delve into this more in our regular technical analysis section on EUR/USD. As expected, the key market mover this week was the U.S. April inflation data.…