San Francisco-based fintech firm SoFi Technologies, Inc. has reported record financial results for the first quarter of 2023, according to its earnings release. The company saw GAAP net revenue of $472 million, representing a 43% increase year-over-year, and adjusted net revenue of $460 million, also up 43% year-over-year. SoFi reported adjusted EBITDA of $76 million, up 772% year-over-year and up 8% sequentially.

Why is Sofi Stock price down?

Shares of SoFi Technologies, Inc. fell 12.2% after the company reported record financial results for the first quarter of 2023. The stock decline was likely influenced by several factors, including negative sentiment towards SPACs and concerns about limited growth potential for revenues in the coming year. Additionally, the recent collapse of First Republic Bank and instability in small banks may have contributed to the decline in SoFi’s share price. While the company’s financial performance was strong, investors may be questioning the sustainability of SoFi’s growth and profitability in the long term. SoFi’s management has expressed confidence in the company’s ability to continue executing on its growth strategy, but it remains to be seen whether the market will regain confidence in the company’s future prospects.

Sofi Earnings Recap

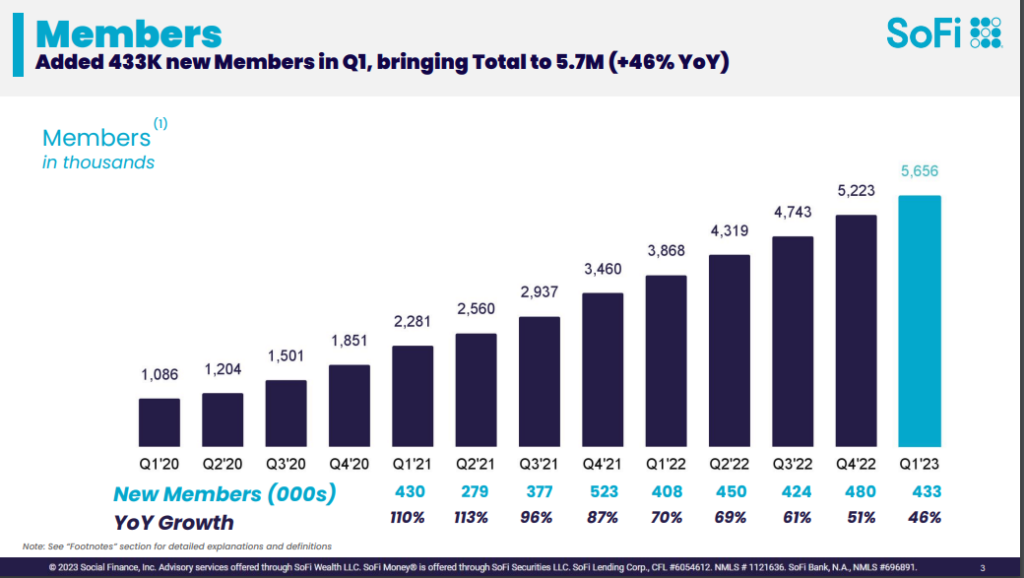

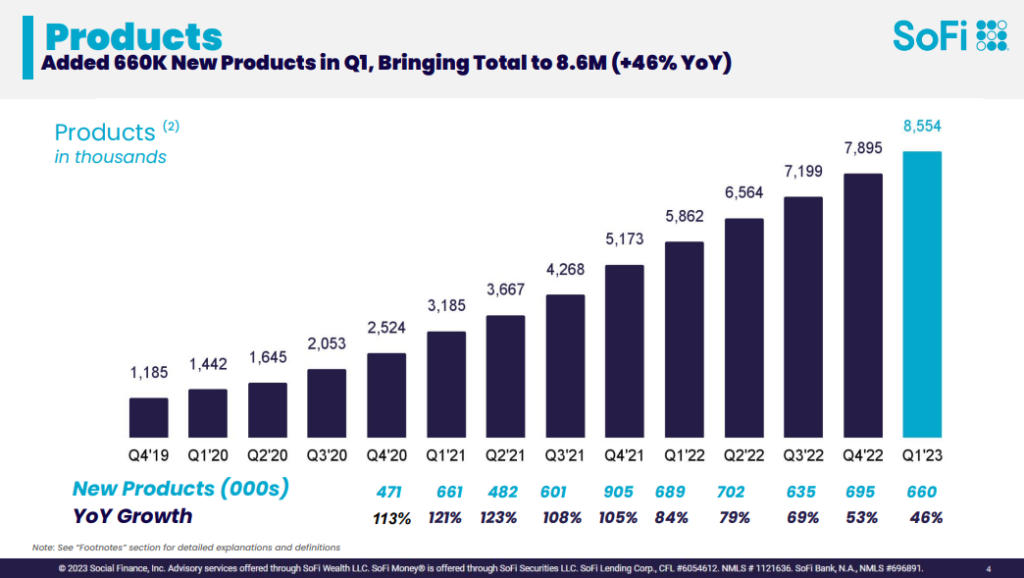

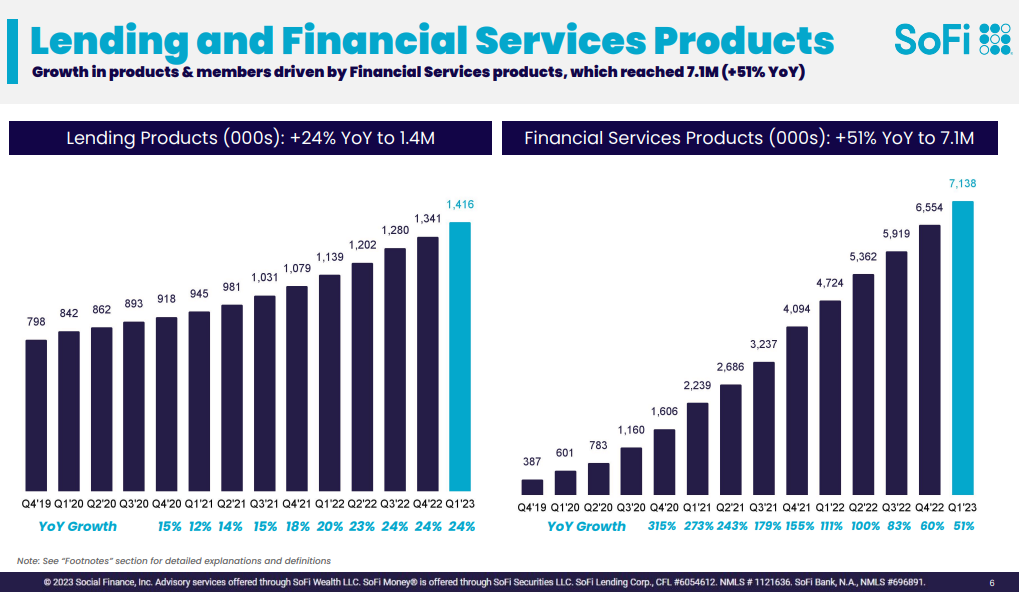

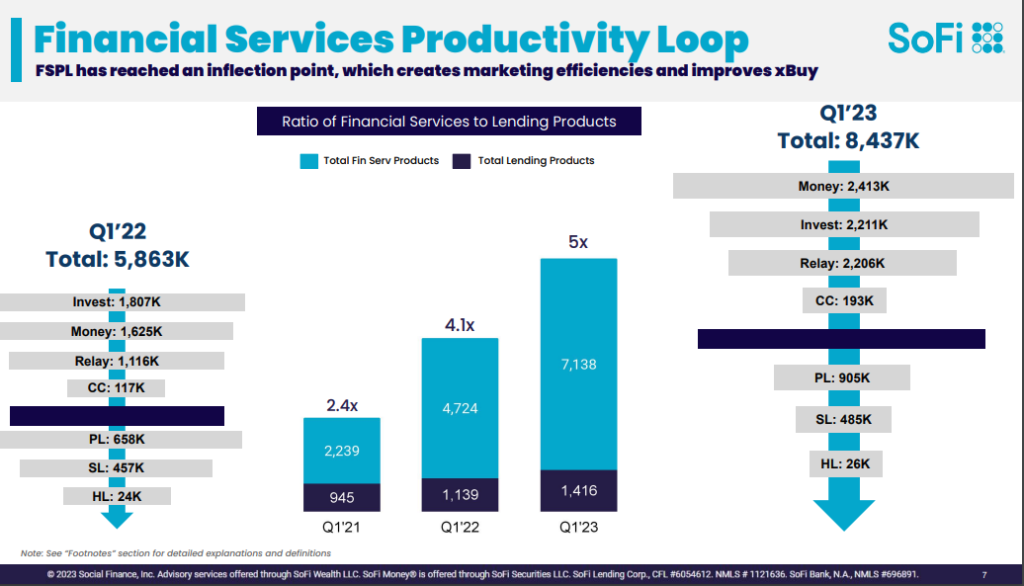

During the quarter, SoFi added over 433,000 new members, bringing its total members to nearly 5.7 million, a 46% increase from the previous year. The company also added nearly 660,000 new products, bringing its total products to nearly 8.6 million, up 46% annually. SoFi’s total deposits grew by a record $2.7 billion, up 37% during the quarter to $10 billion at quarter-end, with 90% of SoFi Money deposits coming from direct deposit members.

As a result of its strong financial performance and growth, SoFi raised its full-year 2023 guidance, including adjusted net revenue of $1.9 billion to $2.0 billion, adjusted EBITDA of $300 million to $325 million, and adjusted net income of $200 million to $220 million. The company’s management expressed confidence in its ability to continue executing on its growth strategy.

Year-to-Date Performance Overshadows Recent Stock Dip

Despite the recent drop in share price, SoFi Technologies’ year-to-date price change is up 21.56%, which indicates that the company’s stock has performed well overall since the beginning of the year. While the recent decline may be a cause for concern, it’s important to note that stock prices can be volatile and subject to fluctuations in response to various factors. SoFi’s management has expressed confidence in the company’s ability to continue executing on its growth strategy, which suggests a positive long-term outlook for the company.

Leave a Reply

You must be logged in to post a comment.