Category: Earnings

-

RBC Raises S&P 500 Forecast to 5300 Amid Economic Optimism

In a recent update to their market outlook, RBC Capital Markets has revised its year-end target for the S&P 500, setting the benchmark index’s goal at 5300, up from a previous forecast of 5150. This adjustment signals an anticipated 11% gain from the December 2023 close, underscoring a more optimistic view of the U.S. equity…

-

Stock Market Weekly Summary

The stock market ended the week mixed on Friday, with the S&P 500 closing up 0.27%, the Nasdaq-100 closing up 3.05%, the Dow Jones Industrial Average closing down 0.68%, and the Russell 2000 Index closing down 0.50%. The mixed performance of the major indices suggests that investors are still uncertain about the direction of the…

-

UBS Anticipates $17 Billion Impact from Hasty Credit Suisse Acquisition

UBS, the Swiss banking giant, anticipates a financial setback of approximately $17 billion stemming from its expedited acquisition of Credit Suisse, as indicated in recent SEC filings. The bank’s calculations suggest a $13 billion impact due to alterations in the fair value of the newly merged entity’s assets and liabilities. Additionally, the bank is bracing…

-

NerdWallet Shares Plummet 22.4% Despite Strong Q1 Earnings Report

Despite reporting strong Q1 2023 earnings, NerdWallet, Inc.’s (Nasdaq: NRDS) stock dropped $9.70, or 22.4%, to $2.80 today, as investors reacted to the company’s financial outlook for Q2 2023. NerdWallet, a leading platform providing financial guidance to consumers and small to mid-sized businesses (SMBs), announced its financial results for the first quarter of 2023, which…

-

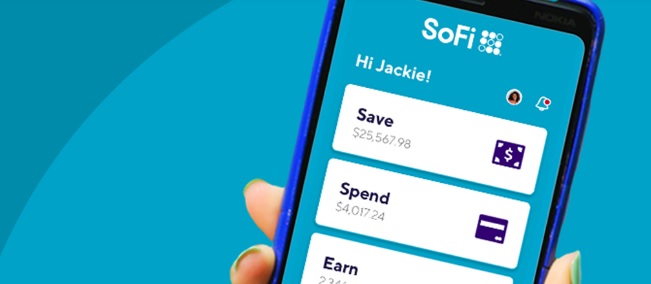

SoFi Technologies’ Stock Decline Continues Despite Strong Q1 Earnings

San Francisco-based fintech firm SoFi Technologies, Inc. has experienced another drop in share price, with the stock falling another 11.96% to $4.82. This follows a 12.2% drop in share price yesterday, which came in the wake of the company’s strong Q1 earnings report. Despite reporting record net revenue and adjusted EBITDA, SoFi’s stock has been…

-

SoFi Technologies Faces Investor Skepticism Despite Strong Q1 Results

San Francisco-based fintech firm SoFi Technologies, Inc. has reported record financial results for the first quarter of 2023, according to its earnings release. The company saw GAAP net revenue of $472 million, representing a 43% increase year-over-year, and adjusted net revenue of $460 million, also up 43% year-over-year. SoFi reported adjusted EBITDA of $76 million,…

-

Stock Futures Daily Update 28

U.S. stock futures experienced a slight decline on Thursday night as investors responded to the latest round of corporate earnings, which included results from tech giants Amazon and Intel, as well as social media platforms Snap and Pinterest. Dow Jones Industrial Average futures fell by 30 points, or 0.09%, while the S&P 500 and Nasdaq…

-

Earnings Drive Wall Street Optimism: U.S. Stocks Rise Amid Busy Reporting Season

U.S. stocks closed higher on Monday as the market continued to focus on a critical round of earnings reports, particularly from financial institutions, following the failure of Silicon Valley Bank last month. The S&P 500 edged up 0.33%, the Nasdaq Composite gained 0.28%, and the Dow Jones Industrial Average added 0.30%. Bond yields were also…

-

JPMORGAN CHASE – FIRST-QUARTER 2023 NET INCOME OF $12.6 BILLION ($4.10 PER SHARE)

JPM strong financial performance across multiple divisions has driven a significant increase in net income, up 52% to $12.6 billion. With net revenue up 25% to $39.3 billion, the firm has experienced growth in Consumer & Community Banking, Corporate & Investment Bank, Commercial Banking, and Asset & Wealth Management, while Corporate results show a shift…

-

888 holdings Share Price Rallies 20.87% Amid Robust Financial Performance

The market responded positively to 888 Holdings Plc’s impressive financial results and Q1 2023 trading update, as the company’s share price soared by 18% today. Investors and stakeholders alike have been encouraged by the solid growth trajectory, strategic focus, and strong liquidity position reflected in the report. The company’s robust performance and commitment to building…