U.S. stocks closed higher on Monday as the market continued to focus on a critical round of earnings reports, particularly from financial institutions, following the failure of Silicon Valley Bank last month. The S&P 500 edged up 0.33%, the Nasdaq Composite gained 0.28%, and the Dow Jones Industrial Average added 0.30%.

Bond yields were also up, with the 10-year note climbing to 3.597% and the two-year note gaining to 4.188%. Several banks, including First Bank, Pinnacle Financial Partners, ServisFirst Bancshares, and CrossFirst Bankshares, are set to report after Monday’s close, offering more insight into the banking sector’s health.

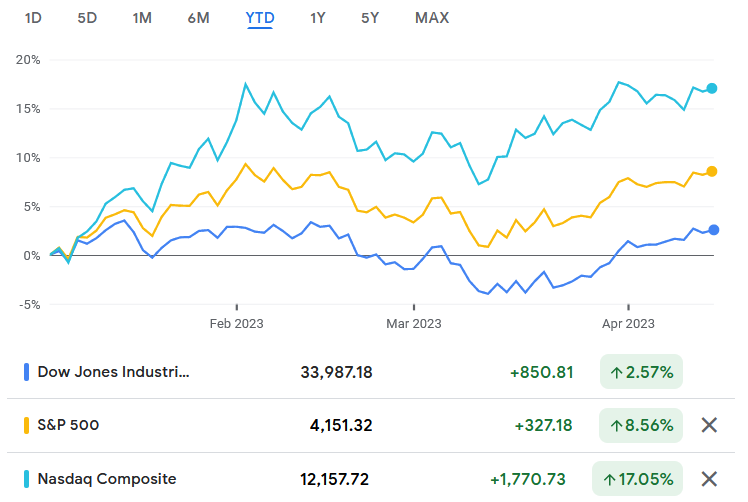

Year-to-Date Growth: S&P 500, Nasdaq, and Dow Jones Surge in 2023

So far this year, the U.S. stock market has experienced significant growth, with major indices posting notable gains. The S&P 500 has risen 8.56%, driven by a broad array of industries and sectors contributing to its increase. The technology-heavy Nasdaq Composite has seen an even more impressive surge, climbing 17.05% year-to-date, as tech companies continue to dominate the market. Meanwhile, the Dow Jones Industrial Average, consisting of 30 blue-chip companies, has also experienced growth, albeit at a more modest rate of 2.57%.

Treasury Secretary Yellen suggests tighter lending standards as alternative to rate hikes

In an interview, U.S. Treasury Secretary Janet Yellen suggested that tighter lending standards could potentially substitute for further rate hikes. Meanwhile, the Cboe Volatility Index, also known as Wall Street’s “fear gauge,” marked its lowest close in over a year, signaling that traders are currently more focused on earnings than on systemic issues following the banking turmoil.

Housing market data and bank earnings take center stage this week

The housing market will also be in the spotlight this week, with confidence among U.S. single-family homebuilders climbing in April. Housing starts, existing home sales, and mortgage rate and application data are all scheduled for release, providing a clearer snapshot of the sector amid a slightly softening rate environment. Unemployment and PMI data are also anticipated, which could impact the Fed’s decision-making ahead of its blackout period.

Leave a Reply

You must be logged in to post a comment.