On Monday (today), regulators stepped in to take over First Republic Bank and proceeded to sell it to JPMorgan Chase, a decisive response to the ongoing two-month banking crisis that has unsettled the financial sector. First Republic, which experienced a significant impact on its assets due to surging interest rates, had been grappling to survive after two other financial institutions failed last month, causing unease among depositors and investors.

The Federal Deposit Insurance Corporation (FDIC) obtained control of First Republic and immediately sold it to JPMorgan. The announcement was made a few hours prior to the scheduled opening of U.S. markets. and followed a weekend of urgent actions by officials. As a result, 84 First Republic branches in eight states will reopen as JPMorgan branches.

The FDIC stated that JPMorgan will “take on all of the deposits and the vast majority of the assets of First Republic Bank.” The regulatory body estimates that about $13 billion from its insurance fund will be required to address First Republic’s losses.

First Republic’s failure comes despite a $30 billion bailout from 11 of the largest banks in the U.S. in March. The bank is the second-largest U.S. bank by assets to collapse, second only to Washington Mutual, which failed during the 2008 financial crisis. The government’s takeover and subsequent sale of First Republic follow its seizure of Silicon Valley Bank and Signature Bank seven weeks prior. The failure of these banks caused ripples across the industry and raised alarm that other regional banks could be exposed to similar withdrawal surges. However, many specialists and executives in the industry maintain a relatively positive outlook, believing that no other medium or large-scale lenders are on the brink of immediate collapse.

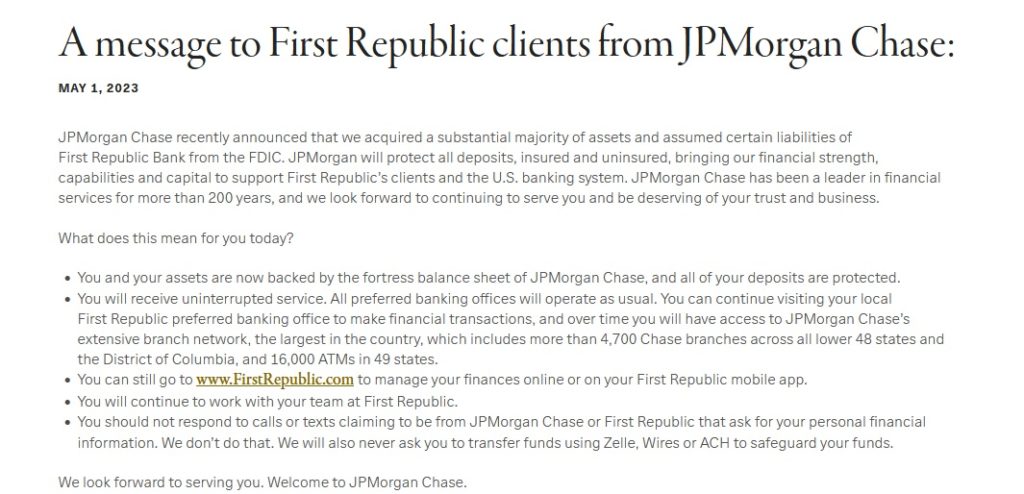

Following the acquisition, JPMorgan Chase published a message on First Republic Bank’s website, announcing the acquisition. In the announcement, JPMorgan reassures First Republic’s clients that all deposits are protected and backed by the financial strength of JPMorgan Chase, and ensures that they will continue to receive uninterrupted service, with preferred banking offices operating as usual and ongoing access to online and mobile banking platforms. The announcement also emphasizes that, over time, First Republic clients will gain access to JPMorgan Chase’s extensive branch network and its network of ATMs.

Leave a Reply

You must be logged in to post a comment.