-

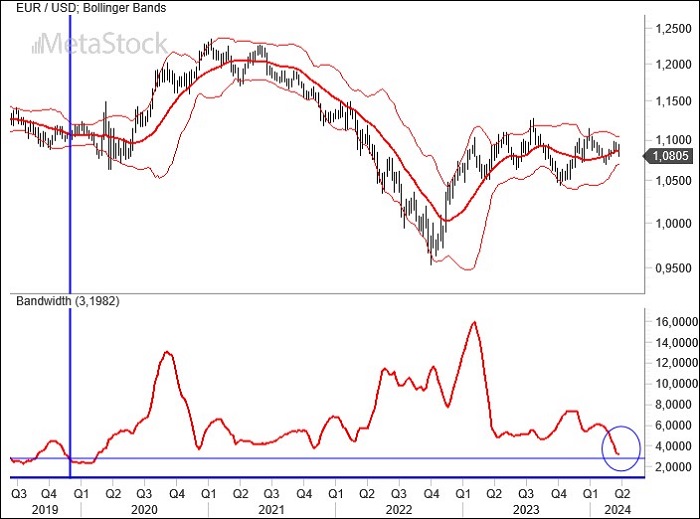

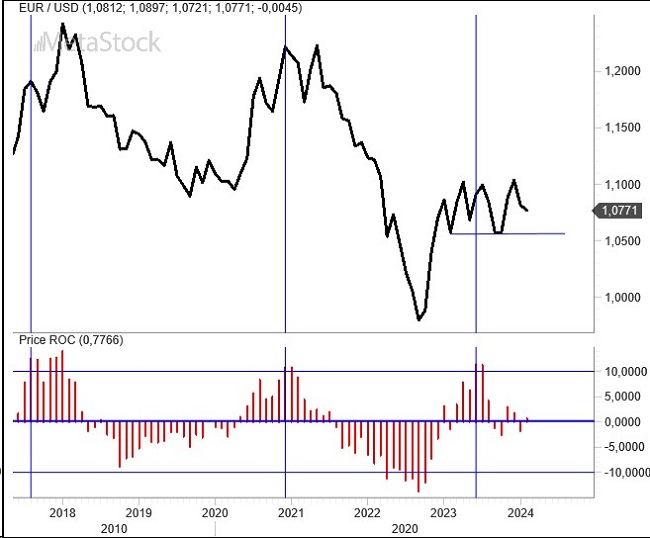

Weekly EurUsd Outlook for April 1, 2024 – Navigating Uncertainty with Interest Rates and Currency Pressures

In a week scarce on data, Powell toned down the dovish remarks that emerged from the last FOMC meeting, indicating that if inflation does not decrease, rates will remain high for longer. This was confirmed by the Fed Chair, who suggested that it is unlikely we will see interest rates return to pre-pandemic levels. The…

-

RBC Raises S&P 500 Forecast to 5300 Amid Economic Optimism

In a recent update to their market outlook, RBC Capital Markets has revised its year-end target for the S&P 500, setting the benchmark index’s goal at 5300, up from a previous forecast of 5150. This adjustment signals an anticipated 11% gain from the December 2023 close, underscoring a more optimistic view of the U.S. equity…

-

Raising the Bar: Oppenheimer’s Stoltzfus Upgrades S&P 500 Outlook to $5,500

John Stoltzfus, in his latest market strategy analysis for Oppenheimer, offers a comprehensive outlook on the economic landscape and its impact on the stock market, with a particular focus on the S&P 500. Here are the critical insights derived from Stoltzfus’s perspective: Stoltzfus’s analysis paints a picture of a robust market environment, where economic stability,…

-

EurUsd Weekly Outlook, March 25, 2024 – The Fed Fuels Market Fire

According to the Fed, there seem to be no major issues in managing inflation, even in a context of upwardly revised economic growth that still promises demand-side pressures. Powell believes there’s no need to tighten further, with the Dot Plots indicating three rate cuts for the current year. The dollar is holding its ground, confirming…

-

SPDR S&P 500 ETF Declares $1.59494 Dividend, Ex-Date March 15

The SPDR S&P 500 ETF Trust (NYSEARCA:SPY) has declared a cash dividend of USD 1.59494 per share. The ex-dividend date is set for March 15, 2024, with the dividend payable by April 30, 2024. This announcement is part of the ETF’s regular dividend distribution strategy, aiming to provide returns to its shareholders. SPY, currently valued…

-

Weekly EUR/USD Outlook for March 11, 2024 – Navigating Rate Cuts and Economic Signals

Powell, speaking before Congress, confirmed what the markets wanted to hear. Rates will decrease over the course of 2024, although the pace will depend on inflation and its resilience. Meanwhile, the ECB keeps rates unchanged in the March meeting, and the euro strengthens above the key support levels of 1.08.

-

EurUsd Weekly Outlook for March 4, 2024 – Navigating the Tides of Central Bank Rhetoric and Market Optimism

Fed Rate Cuts, Robust Growth, and Political Dynamics Once upon a time, there were anticipated rate cuts promised by the Fed. With each passing week, expectations for a reduction in the cost of money have shrunk, and as of today, the market anticipates a cut of 75 basis points by the end of 2024, down…

-

EurUsd Weekly Outlook for February 26, 2024 – Navigating Through Low Growth, Rate Expectations, and Seasonal Trends

Few news are coming from the United States where the market is becoming more realistic about the evolution of monetary policy. Amid alternating statements from various central bankers, the market has acknowledged that there will be no reductions in the cost of money before summer. Meanwhile, in Europe, all growth estimates have been revised downwards,…

-

EurUsd Weekly Outlook for February 19, 2024 – Is the Trend Reversal Upon Us?

To see inflation with a 2 in front of it in America, we will have to wait a bit longer. The annual change in American consumer prices has negatively surprised analysts, even in the core figure stripped of volatile components. A rate cut in the United States becomes more distant, while it’s a current topic…

-

Weekly EurUsd Outlook for February 12, 2024 – Powell’s Caution and Europe’s Struggles Shape Markets

A Mixed Markets Outlook In a media interview, Powell took a cautious stance. We are convinced that the path back to 2% is underway, declared the Federal Reserve Chairman, but it’s better to be prudent given the recent and very positive results from the job market. Translating this into practical terms, even the rate cut…

-

EurUsd Weekly Outlook for February 5, 2024 – Fed Holds Rates Steady, Eyes on ECB for Spring Cut

The Fed holds firm on rates, promising markets that a cut will come but only when inflation has provided concrete signs of definitively converging towards 2%. In Europe, zero growth in the fourth quarter was confirmed, anticipating a rate cut in spring. EurUsd continues to press on the 1.08 supports.

-

EurUsd Weekly Outlook for January 29, 2024 – A Period of Calm Amidst ECB Steadiness & Market Anticipation

Trump continues his ride in the Republican primaries, which should lead him to be the candidate in the challenge against Biden. Markets remain calm in a data-scarce week with the ECB as the sole protagonist, yet offering few leads for investors. EurUsd reaches significant support levels, beyond which windows favorable to the American dollar would…