- U.S. inflation rises above 3%, and hawks circle a Fed that has so far done an excellent job. A rate cut before May seems unlikely, while the electoral challenge between Biden and Trump takes shape.

- Germany remains the main problem of a slowing Europe, which this year will also experience the renewal of Parliament with the June elections. The ECB might cut rates in spring.

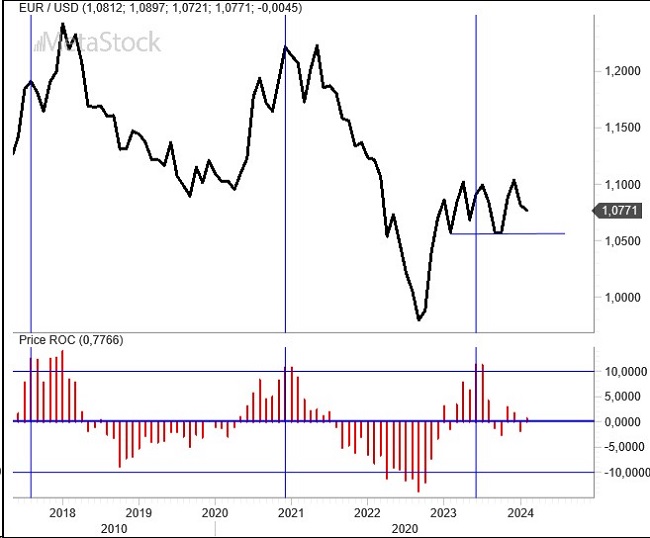

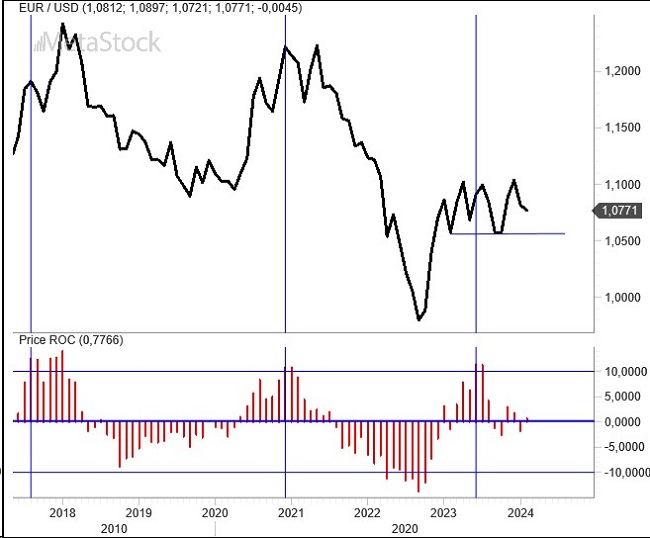

- EurUsd breaks below the 1.08 support levels and could head towards levels that will complicate the ECB’s task of containing inflation. The attempt at a reaction at the end of the week suggests that nothing is decided yet.

Inflation Surprises and Political Battles: EurUsd Faces a Shifting Landscape

The downward break in EurUsd anticipated the event: a less-than-expected decrease in U.S. inflation and the interest rate cut now seeming more distant, likely occurring in the heart of summer. January saw a consumer price increase in America of 3.1%, while analysts had been anticipating a drop below the 3% threshold. The core rate, which excludes volatile components, stopped at the 4% mark.

Powell was right to urge caution, and the dollar had good reason to strengthen slowly but surely. Thus, U.S. yields are rising again, including those long-term ones that had fallen below the 4% mark a few days ago. From a technical perspective, as we will see shortly, the fate seems sealed in the short term, but the nightmare for the euro appears to materialize in the medium term as well.

Meanwhile, the presidential battle continues to dominate headlines with Biden being attacked over age issues and Trump over legal matters. For now, the stock market is smoothly sailing towards record highs, almost savoring a political fragility that will leave the field open for business.

On the other side of the Atlantic, Europe still struggles to emerge from the doldrums. For instance, the German Zew Index signaled an improvement in the expectations component but a worsening in the current situation component. This indicates that economists are hopeful but still do not see the light at the end of the stagnation tunnel. For Europe, a cut in the cost of money appears more likely in spring if inflation continues its downward trajectory combined with economic stagnation. This, in theory, should harm the euro.

Technical Analysis: EurUsd’s Path Through Support Breaks and Potential Rebounds

The last two primary highs (three, including that of 2023) for EurUsd materialized when the semi-annual change in the exchange rate rose above +10%. The exhaustion of the movement not before a -10%. If this were to be the case for EurUsd, parity would not be a factor to dismiss outright, with a scenario that, after breaking support levels of 1.08, seems to turn in favor of the strong dollar from the perspective of expected growth differential, but also of yield.

With the downward break of the 200-day moving average and the support band of 1.08, EurUsd theoretically opens the door to a return between 1.04 and 1.06, respectively 38.2% and 50% retracement of the entire previous rise that culminated in July 2023 with 1.127. The sentiment in favor of the American dollar does not yet appear extreme, and oversold indicators (such as the RSI) have not yet reached levels that would suggest the end of the bearish phase. However, attention should be paid to the euro’s reaction at the end of last week, which seems to indicate that the game is not yet over.

Leave a Reply

You must be logged in to post a comment.