- The Federal Reserve has not disappointed the markets, especially the stock markets, by indicating that there are likely to be three interest rate cuts during 2024 while also raising economic growth estimates for the current year. This has led to a rally in equity markets and stability for the dollar.

- There has been a marked slowdown in labor costs in the Eurozone in the fourth quarter of 2023, making a rate cut in June seem inevitable due to the Eurozone’s economic difficulties.

- The EurUsd has once again unsuccessfully tested the 1.10 resistance levels after a brief bearish excursion, confirming that the 1.08 support zone is currently very solid.

Inflation Under Control, Says Powell

In a surprising move, the FOMC has indicated the Fed’s willingness to cut interest rates three times over the course of 2024, setting the stage for new highs in the stock markets. Powell opened the press conference by noting that inflation is indeed slowing, but not as much as expected, which is why the Fed will remain vigilant. However, he noted that the peak has been reached. The impression, however, was that this is only a temporary deviation that will soon return to the expected path, which explains why the Dot Plots suggest that there will probably be three interest rate cuts in 2024. There were some contradictory signals from the FOMC, such as the upward revision of economic growth forecasts, likely taking into account a reduction in the cost of money to below 5%. The Fed members’ dot plots indicate interest rate forecasts of 4.5%/4.75% for 2025, a year for which growth has been revised upwards to 2% (after a significant review to 2.4% in 2024). Core inflation, on the other hand, is not expected to return to 2% until 2026.

Regarding Europe, the atmosphere remains one of anticipation following Lagarde’s comments, which effectively postponed everything to June. Good signals persist regarding the narrowing of spreads between core and peripheral Europe, indicating that, for now, there seem to be no major internal problems in Europe. Rather, it’s at the borders where geopolitical tensions risk putting greater pressure on European budgets, which will need to account for increased defense spending in the coming years. A significant slowdown in European labor costs in the fourth quarter is noteworthy. The 3.4% is a sharp decline from the 5.2% of the third quarter. The market is pricing in a first move at the June ECB meeting.

Technical Analysis: EurUsd Faces Tight Volatility and Key Levels Signal Upcoming Trends

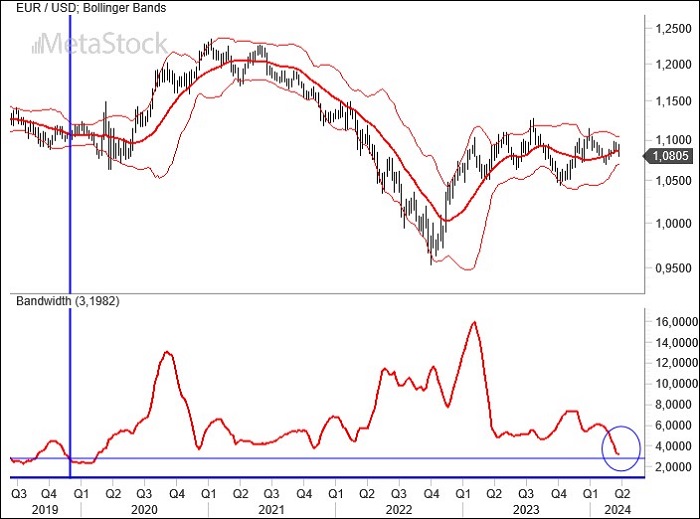

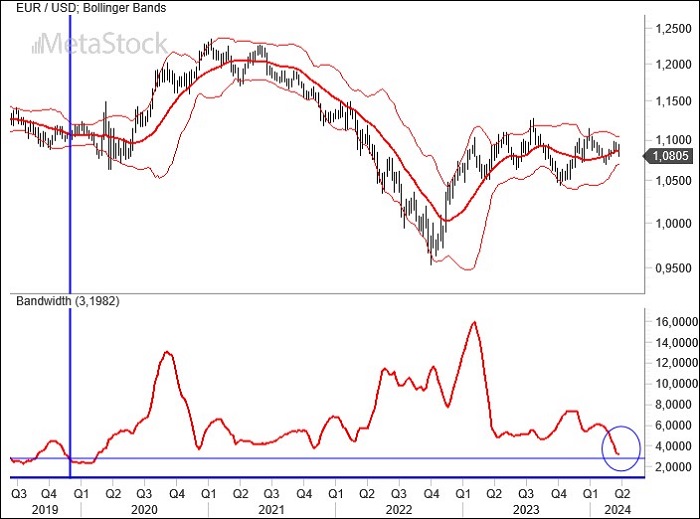

Volatility on EurUsd continues to contract, and Bollinger bands this close on a weekly scale have not been seen since the end of 2019, a period sadly remembered for coinciding with the outbreak of the pandemic, first in China and then globally. In that case, the Fed’s decisive action on rates to provide liquidity to the economic system favored a sharp acceleration of EurUsd upwards. We cannot know if it will be the same this time, but it is undoubtedly worth monitoring the lower (1.07) and upper (1.105) levels of the bands since such compressed volatility may signal a new and significant trend. Given the recent discussion on seasonality, the expectation remains for some weakness of the dollar in the coming months.

The daily bar chart of EurUsd once again underscores the importance of the 200-day moving average. Approached before the FOMC and then again at the end of the week, this moving average confirms its ability to contain attempts to strengthen the dollar, but also highlights the sensitivity of a downward breach. Within a trading range, the moving average acts as a sort of watershed. Looking upwards, between 1.105 and 1.11, we find a solid resistance barrier that will test the euro’s ability to decisively target much more ambitious levels during the summer.

Leave a Reply

You must be logged in to post a comment.