Category: FOMC

-

Weekly EurUsd Outlook for August 26, 2024 – Dollar Freefall Amid Powell’s Rate Cut Signal

Markets are in sync with Powell and the Fed, as Jackson Hole saw the announcement that the time for rate cuts has arrived. The U.S. economy is slowing down, job creation is falling short of estimates, and inflation is gently retreating. A similar situation is unfolding in Europe, but it was enough for the stock…

-

Weekly EurUsd Outlook for August 12, 2024 – Fed Holds Steady Amid Market Volatility

Market Volatility Rises Amid Geopolitical Tensions and Fed Speculation Markets remain highly volatile across both bond and equity sectors. Geopolitical tensions, combined with shifts in speculative carry trade positions and uncertainty surrounding upcoming U.S. macroeconomic data, are driving a cautious approach. The market appears to have moved too aggressively in predicting a 125 basis point…

-

Weekly EurUsd Outlook for July 22, 2024 – Fed & ECB Rate Cuts on the Horizon, Biden Withdraws

Biden has decided to step back from the presidential race, and this event, following the attack on Donald Trump, further fuels uncertainty about the outcome of the November election. Meanwhile, the market is convinced of a Fed Funds rate cut in September. The ECB remains on standby, announcing a possible move in September if inflation…

-

Weekly EurUsd Outlook July 8, 2024 – French Vote Shakes Markets

The French elections seem to have almost benefited the euro, which had dangerously approached critical support levels. The prospect of political stagnation combined with uncertainties on the American electoral front, as well as a certain stand-by on interest rates, help to keep the trading range on EurUsd active.

-

EurUsd Weekly Outlook June 24, 2024 – Euro Tensions and Dollar Dynamics

French Elections and the Fed Under Scrutiny France remains at the forefront with its political crisis, expected to be resolved soon with the upcoming political elections. Currently, the euro is experiencing some pressure, though it is relatively mild. The spread between France and Germany has surged beyond 70 basis points, the highest in the last…

-

Weekly EurUsd Outlook for June 17, 2024 – Fed Stance and European Politics Drive Market

Europe has weathered the impact of nationalism after the parliamentary elections, although there have been some national disruptions (see France), which are weighing down the euro. In the United States, inflation continues to slow, but the Federal Reserve has informed the markets that there will be at most two rate cuts in 2024, postponing expansionary…

-

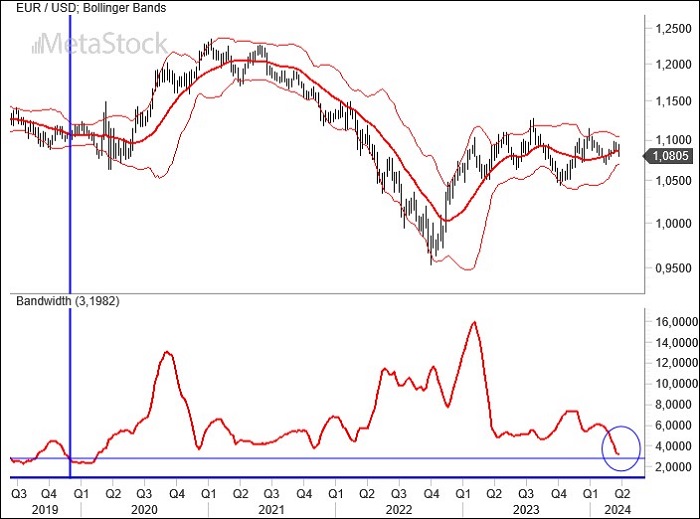

EUR/USD Weekly Outlook for May 27, 2024 – Low Volatility and Central Bank Anticipation

The minutes of the latest Federal Reserve meeting highlighted that it is still not time to cut rates in the United States. Upcoming data will be crucial in determining if such a move will be made in 2024, while the ECB appears ready to proceed with it as early as June. EUR/USD remains without clear…

-

Weekly Outlook for EurUsd as of May 6, 2024 – Dollar’s Defense Tested Amidst Economic Uncertainty

As predicted, the Fed keeps rates unchanged at 5.5%, while simultaneously slowing down the pace of reducing the central bank’s balance sheet. The economy continues to run at full throttle, coupled with low unemployment, which prevents inflation from decreasing as expected, forcing the Fed to maintain a restrictive monetary policy. The dollar remains strong but…

-

EurUsd Weekly Outlook, April 8, 2024 – Crosscurrents of Global Monetary Policies

Powell plays the firefighter and urges caution on rate cuts. The American economy continues to produce encouraging data, including on the employment front, causing stock markets to halt their gains while bond yields rise. The dollar attempts an assault on the euro, where inflation is increasingly contracting, but without success. The EurUsd supports hold steady…

-

EurUsd Weekly Outlook, March 25, 2024 – The Fed Fuels Market Fire

According to the Fed, there seem to be no major issues in managing inflation, even in a context of upwardly revised economic growth that still promises demand-side pressures. Powell believes there’s no need to tighten further, with the Dot Plots indicating three rate cuts for the current year. The dollar is holding its ground, confirming…