- Market Expectations Dashed by the Fed: The market was hopeful for a slowdown in inflation in May, but the Fed dashed these hopes, confirming that there will almost certainly be only one rate cut this year. There is still too much economic growth, and the risk of a second round of inflation remains.

- Political Shifts in Europe: Political elections in Europe are not causing major disruptions overall, although France has seen a significant shift to the right, forcing President Macron to call for new elections. French spreads are widening, and the euro is falling.

- EurUsd Movement: EurUsd is trading at the lower end of its range. The French political turmoil, combined with the prospect of a more accommodating Fed next year, keeps the exchange rate technically flat.

Fed Dampens Optimism, ECB Cautious, and European Elections Stir Markets

Before the FOMC, markets were hopeful. May inflation in America showed a further slowdown to 3.3%, with the core rate even lower at 3.4%. However, Powell poured cold water on this optimism by confirming that there will be only one rate cut in 2024 at most. The Fed’s operational arm of monetary policy has not yet seen evidence that inflation is steadily converging towards 2%. The market is now pricing in a full cut in November, partly due to very reassuring employment data that could increase wage pressures.

Meanwhile, Europe has issued two verdicts. The first is the initiation of an easing phase by the ECB, which, however, seems to be hedging its bets. Lagarde has stated that it could be a long time before the next rate cut. The market doesn’t even see a 100% probability of a cut by December 2024, and as with the US, data will define the new path for easing the cost of money. Industrial production data continues to be discouraging, with a 3% year-on-year drop in April, with Germany remaining the laggard of the EU.

The second verdict came from last week’s elections. Overall, the European Parliament has shifted to the right, but there are no major upheavals in the parliamentary majority, which should support Ursula von der Leyen’s re-election as President of the European Commission. The real issues come from France, where President Macron, having suffered a defeat, has called for new elections that could crown Le Pen’s party as the country’s leader. French Oat-Bund spreads are soaring, the French stock market is falling, and the euro is down.

Technical Analysis: EurUsd Swings but Holds Key Supports

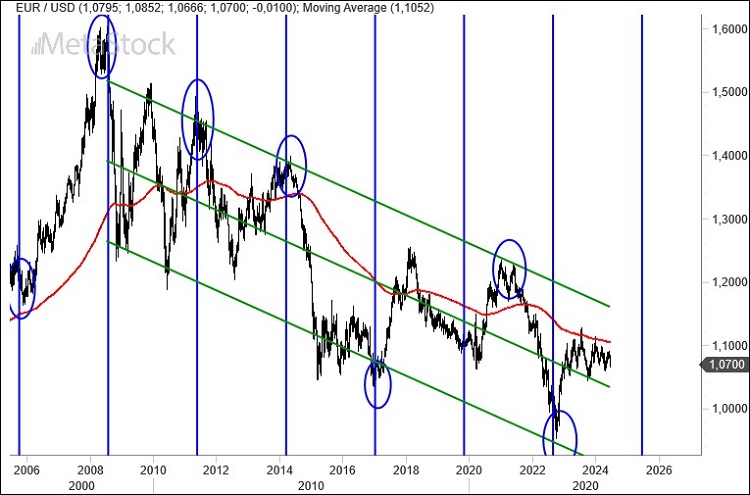

EurUsd moved after various events in Europe and America regarding rates and politics. There was some volatility, but it didn’t lead to any major breakouts of key supports and resistances, at least for now. First, a sharp drop of almost 200 pips from 1.09 to 1.07 followed the French political instability that forced President Macron to call for new elections. Then, the Fed and inflation data set the stage for a rebound back to 1.08, driven by the perception that political balances in Europe would allow for the quick formation of a new European Commission. This was followed by another decline, again with France being the main culprit.

Thus, the week ended with EurUsd down but still above the first critical supports at 1.065, with 1.05 serving as the primary dividing line.

In a stable phase like this, we can look further ahead, updating the cyclical model that predicts a significant peak or trough in EurUsd exactly one year from now. This model, which has performed well since the 2008 crisis, should be considered seriously. For the probability of this turning point being a peak to increase, a decisive break above the resistances at 1.10/1.12 is needed. For a trough, a bearish break below 1.05 is required.

In summary, while the immediate outlook for EurUsd is influenced by political and economic developments, the long-term cyclical model suggests that a major turning point is on the horizon, warranting close attention to upcoming market movements.

Leave a Reply

You must be logged in to post a comment.