- Trump’s incursion into Davos failed to deliver the desired results. Ignored by European leaders, the tycoon made a dramatic U-turn, abandoning plans to buy—or invade—Greenland. Tariffs were scrapped and market volatility quickly eased.

- Europe responded in a united front to U.S. threats, sending them back to sender and reaffirming its determination to remain politically cohesive despite its many challenges. At the same time, the economy is showing signs of awakening.

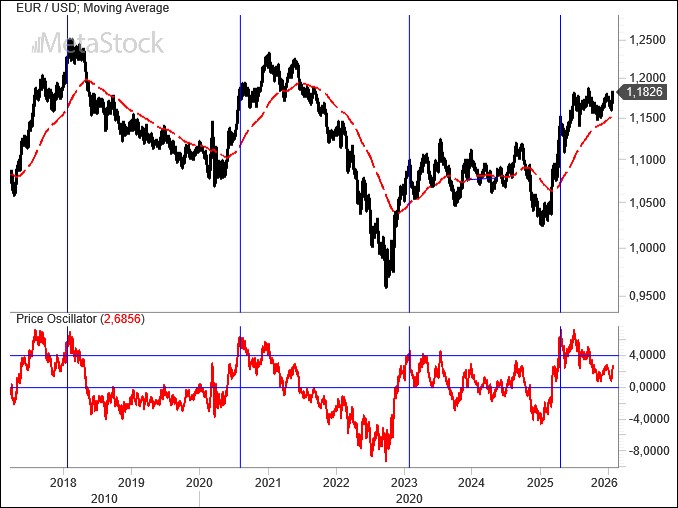

- EUR/USD rebounded promptly on tensions sparked by Trump, who first threatened tariffs and then withdrew them. The trading range therefore remains intact, but the euro is now testing resistance around 1.19.

The bluff is exposed

Once again, the U.S. president attempted to strong-arm his economic and military partners in an effort to force negotiations in Washington’s favor. On Greenland, however, Trump pushed the bar too high, triggering reactions from long-standing allies such as Canada and Europe, both ready to respond on the very terrain threatened by the tycoon—tariffs. All of this was compounded by a far from negligible factor that ultimately convinced the president to step back.

More than 40% of U.S. public debt is held by European institutions, and on Monday someone evidently thought it wise to place the potential sale of Treasuries squarely on the negotiating table. The result was swift: 10-year Treasury yields jumped to 4.3% and the dollar slid toward 1.18 against the euro.

In the end, Trump appears to have taken a more conciliatory stance, accepting a NATO intervention in Greenland and agreements on the exploitation of its rich rare-earth deposits. For now, that may be enough, but former European and Canadian allies remain unconvinced. The Trump cyclone is unlikely to stop here, and further episodes should be expected.

Meanwhile, discussions continue within the White House over replacing Jerome Powell at the Federal Reserve. The name of a future Fed chair remains undisclosed, though markets assume someone closer to Trump’s views and therefore inclined toward a less hawkish approach on rates. The economy, however, is performing reasonably well, making the issue far from easy to resolve.

As for Europe, despite the turbulence, economic indicators remain encouraging. Germany’s ZEW index confirms the improvements under way across the continent and in Germany itself, which has put behind it a fourth quarter that exceeded expectations.

EUR/USD, the dollar’s missed opportunity

There is no need for particularly complex analysis to understand what happened to EUR/USD last Monday, given the market’s remarkably clear reaction to the tone of the confrontation between the U.S. and Europe.

The dollar was approaching a crucial support level around 1.15, below which a move back toward 1.12 could have been reasonably forecast in a context favorable to the greenback.

Instead, the opposite occurred, with dollar weakness coinciding with a rise in long-term U.S. yields—an indication of capital potentially flowing out of U.S. assets.

A warning shot across the bow for the tycoon? Time will tell. What is certain is that for Trump it could be dangerous to allow EUR/USD to “challenge” resistance at 1.19. A breakout would be strongly bullish for the coming spring months, when the dollar’s seasonal support typically fades.

Perhaps, however, the timing for an upside breakout in EUR/USD is not yet ripe. That is what the price oscillator seems to suggest—an indicator that measures the difference between the spot price and a long-term moving average.

As the chart shows, when the price oscillator exceeds certain levels it signals the need for a pause in the exchange rate, not necessarily an immediate major top.

This is precisely what occurred in recent months, with the indicator first entering overbought territory and then diverging from price, facilitating the start of the current sideways phase.

That phase is gradually repositioning EUR/USD toward its moving average. Should a downside break occur, the outlook for the dollar would become more constructive. For now, however, this scenario appears unlikely, and a dramatic upside breakout—opening the door to ambitious bullish targets for the spring—cannot be ruled out.

Leave a Reply

You must be logged in to post a comment.