- The past week brought little in the way of surprises from U.S. labor market data, but political tensions at home are mounting. As markets attempt to digest the escalating feud between Donald Trump and Elon Musk, a glimmer of optimism comes from overseas. A new round of China-U.S. talks—set to take place in Europe—has somewhat calmed investor nerves.

- On the other side of the Atlantic, eurozone inflation continues to trend steadily toward target, giving the European Central Bank the green light for another rate cut. The ECB lowered rates to 2%, bolstered by a euro that remains attractive to global investors. Meanwhile, the EUR/USD pair is again testing the 1.15 resistance zone—a critical threshold. Should it break above, it could signal a broader wave of dollar weakness.

ECB Cuts Rates as Trump Escalates Tariff Threats

Two months after Trump’s so-called “Liberation Day,” there’s been little real progress in implementing new tariffs or striking fresh trade agreements. Talks with China are stalled, though a new summit scheduled for London offers a potential turning point. Relations with Europe remain similarly stagnant, overshadowed by looming legal disputes and procedural delays. Adding to the uncertainty, Trump once again proposed doubling tariffs on steel and aluminum—rattling both markets and diplomatic ties.

The week’s most important macro development came from the U.S. labor market. Employers added nearly 140,000 jobs and the unemployment rate ticked up slightly to 4.2%. Wages rose more than expected, hinting at some underlying tension in the job market.

These developments, combined with a slight dip in long-term Treasury yields, have pushed the dollar back onto the defensive. Without a strong rate differential in its favor, the greenback might have already slipped well beyond the 1.20 mark against the euro. And as if economic pressures weren’t enough, the public breakdown in the relationship between Trump and Musk has further unsettled markets.

At present, the euro stands out as the most credible alternative to the dollar. ECB President Christine Lagarde had previously suggested that international capital flows into the eurozone could help support the currency, especially now that inflation appears to be under control.

In line with expectations, the ECB cut rates to 2%—a move backed by cooling inflation figures. The central bank also revised its inflation outlook for 2025 down to exactly 2%. With growth forecasts nudged upward to +0.9%, the eurozone may now be operating at a neutral interest rate level. Still, the path forward for monetary policy in Europe is increasingly uncertain.

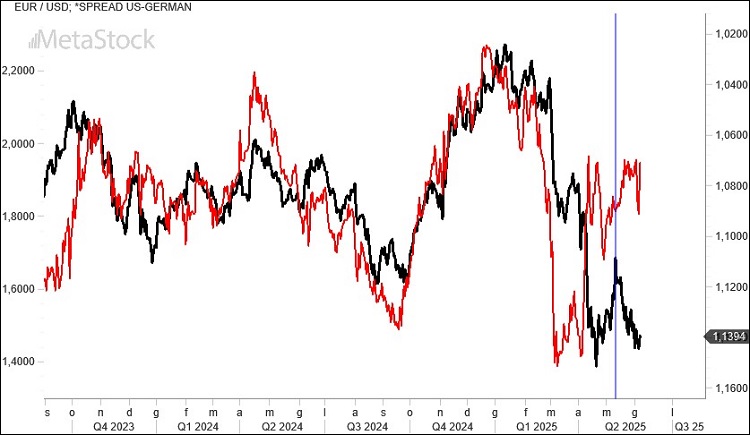

Technical Analysis: Why the Dollar Still Struggles Despite Higher Rates

Despite the dollar offering higher yields than the euro, the exchange rate tells a different story. EUR/USD has been climbing—even as the rate spread between U.S. Treasurys and German Bunds widens. This divergence suggests that investors are demanding a greater risk premium to hold dollars, viewing them as less of a safe haven than in the past.

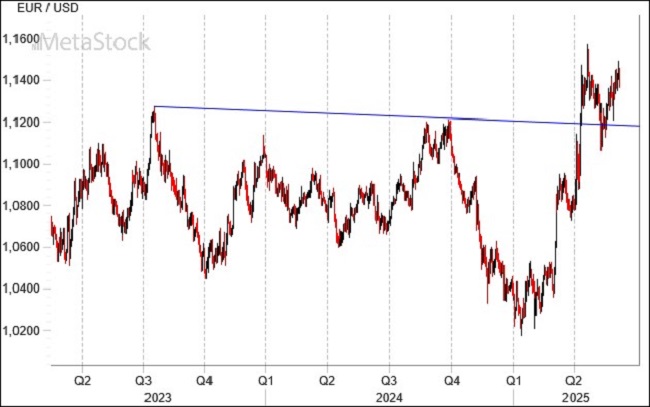

Following its breakout in April, EUR/USD saw a textbook pullback, bouncing off a former resistance level that now acts as support. The bounce confirms that markets are unwilling—for now—to reverse course. It also reinforces the significance of the 1.12 support area, while putting pressure on the 1.15 resistance zone.

A clean break above 1.15 could pave the way for a rally toward 1.20.

Leave a Reply

You must be logged in to post a comment.