- The U.S. inflation data positively surprised with a core rate at 4%, reigniting hopes for Fed rate cuts as early as spring 2024.

- The euro gains on prospects of cooling inflation in the Eurozone and a potential avoidance of recession in the fourth quarter. Meanwhile, rating agencies upgrade Italy, narrowing the spread with German bunds.

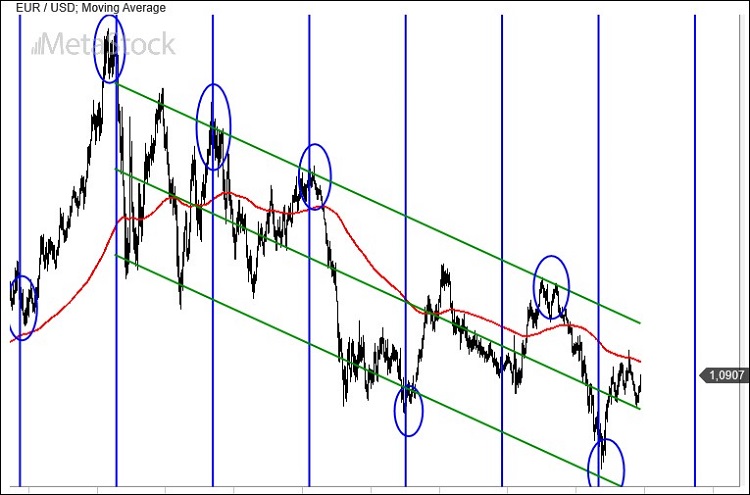

- On the technical side, the EurUsd swiftly reverses its trend, surpassing the 200-day moving average. Is this indicative of a trend reversal?

An Overly Exuberant Reaction

The market’s reaction to the U.S. inflation data was strong and optimistic, perhaps excessively so. Following the release of the October U.S. consumer price index figures, stocks and bonds surged, while the dollar plummeted. But is all that glitters gold? Not necessarily.

U.S. inflation in October rose less than expected (3.2%), with the core figure at 4%. Still too high, but enough to make markets believe that 2024 will see several interest rate cuts. This is true, but only if the economy starts showing signs of slowing down, especially in the labor market, which the central bank continues to closely monitor as a potential trigger for a new surge in consumer prices.

A deeper analysis of the inflation rate is warranted. True, it has slowed down, but credit goes to certain components like transportation, which had a significant impact in October. In contrast, housing and food costs continued to show solid monthly growth (+0.3%). Nevertheless, expectations of Fed rate hikes have evaporated, with a market-anticipation of first rate cut as soon as May 2024. Perhaps an excessively optimistic view.

U.S. retail sales fell for the first time in seven months by 0.1%, better than the forecast. A bit of good news on inflation came from producer prices, which fell in October.

A general scaling back of consumer prices is also evident in Europe. In Britain, inflation dropped from 6.7% in September to 4.6% in October, and a similar trend is expected in upcoming Eurozone data. Europe might avoid recession in 2023, with the Commission forecasting GDP growth of 0.2% in the third quarter. Meanwhile, rating agencies have upgraded Italy, moving it out of a negative outlook. This is good news for Italian government bonds, which are seeing a reduced spread with German Bunds.

Meanwhile, the prospect of rate cuts in the United States is rekindling the euro.

EurUsd Technical Analysis – A Real Trend Reversal?

EurUsd has regained its 200-day moving average in a surge that rekindles hopes for a year-end euro rally. The movement was explosive and unexpected, pushing the exchange rate above technical levels that had previously delimited bullish/bearish trends.

At this point, we cannot rule out a return to what might be, in a long-term perspective, the most delicate technical resistance level, positioned around 1.12/1.13. Everything will depend on the central banks’ decisions in December.

The divergence that had opened between EurUsd (which was already starting to fall) and the spread between the 10-year U.S. Treasury and German Bund (which was rising) has resolved with a sharp decline in the rate differential, now aligning with the exchange rate trend.

EurUsd’s rebound paused, finding support at the long-term bearish regression line, from which it recently relaunched its action. This action could have room, in the context of a secular downtrend of the euro, up to 1.17, a transit zone of the two standard deviations that define the upper boundary of the bear market.

Leave a Reply

You must be logged in to post a comment.