- The Fed has chosen to hold interest rates steady, signaling further increases in an effort to temper the economy without plunging into a recession. A new rate hike is anticipated by year-end.

- Following last week’s rate surge and the Fed’s decision, Lagarde has little choice but to adopt a neutral stance on monetary policy, even as the European economy displays evident signs of deceleration.

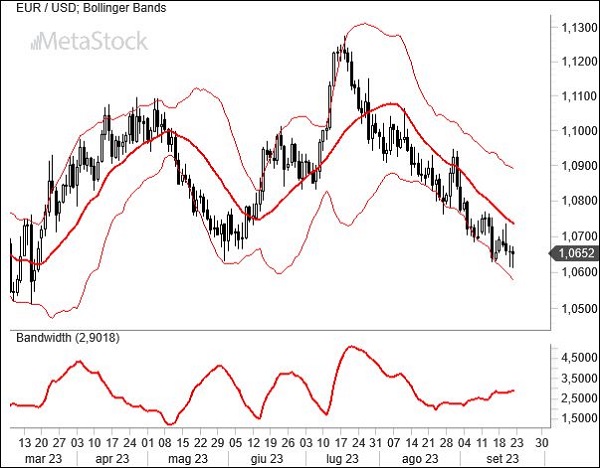

- EurUsd remains under pressure around the 1.065 support level, but there’s an underlying sentiment that new lows may be on the horizon.

The Fed favors high rates.

The Federal Reserve (Fed) continues its tight grip on interest rates and even doubles down. At the latest monetary policy meeting, the central bank held rates steady but exhibited a more hawkish stance than expected. This vigilant approach was in light of recent surges in oil prices and concerns over potential wage spikes, especially in the automotive sector where multiple strikes are highlighting tensions between unions and companies over workers’ purchasing power.

Chairman Powell hinted that sentiments in Washington lean towards another slight increase in money costs, with central bank forecasts indicating a possible rate hike to 5.75% before a more extended hold. The September pause is merely an intermediate step in a journey that has already seen interest rates reach their highest levels since 2001.

Ultimately, the data will dictate the course, signaling heightened volatility across all financial markets as stakeholders hang on Powell’s every word, speculating on the next monetary policy direction after each data release. FOMC member estimates, are projecting rates above 5% by the end of 2024. While discussions about rate cuts will ensue, the outlook has undoubtedly benefited a dollar bolstered by significant real rates. The Fed’s inflation projections for 2024 indicate consumer prices at 2.5%. Both unemployment and GDP forecasts exclude a recession, predicted at 4.1% and 1.5%, respectively.

It’s clear the Fed aims for a soft landing of the economy, and a policy reversal is unlikely until the data underscores its necessity. Europe’s position is precarious, with economies like Germany already in recession. Reducing the cost of money is complex given the Euro’s weakening from growth and rate differentials expanding towards the U.S. Hence, European Central Bank’s Christine Lagarde will likely maintain a cautious stance, avoiding an overly dovish demeanor, which could precipitate a further drop in the Euro and subsequent imported inflation.

Technical Analysis – the Decline Isn’t Over for the EurUsd

EurUsd has surpassed expectations by breaking through the distinct 200-day moving average that had supported the Euro’s rise. The currency failed to reclaim its dynamic support, which is now acting as resistance. The Fed’s decision necessitates an overweight in dollars by asset managers fearing a deteriorating European economic and inflationary outlook. Technical analysis indicates that the Wolfe waves, forecasted weeks ago, have now been charted. Current theory suggests the dollar’s strength won’t wane until it reaches between 1.04 and 1.045. Only then can one contemplate a potential Euro rebound.

This viewpoint, derived from the analysis presented, would begin to show cracks if it rose above the 20-day moving average currently at 1.074. If it surpasses that (and subsequently the 200-day average of 1.08), a trend reversal can be considered. Currently, the market isn’t favoring this scenario, and even sentiment indicators, not overly pessimistic on the Euro, seem to advise against it. However, it’s worth noting the seasonality: starting in October, the dollar typically weakens through year’s end.

Leave a Reply

You must be logged in to post a comment.