-

Weekly EUR/USD Outlook for December 16, 2024 – Inflation and ECB Rate Cuts Shape Market Sentiment

The two most important central banks in the world will close out 2024 with similarly intense rate cuts. The ECB has already announced its 25 basis point reduction, and the Fed will follow suit next week. However, the path for the new year appears divergent, which explains the strength of the dollar, which remains firmly…

-

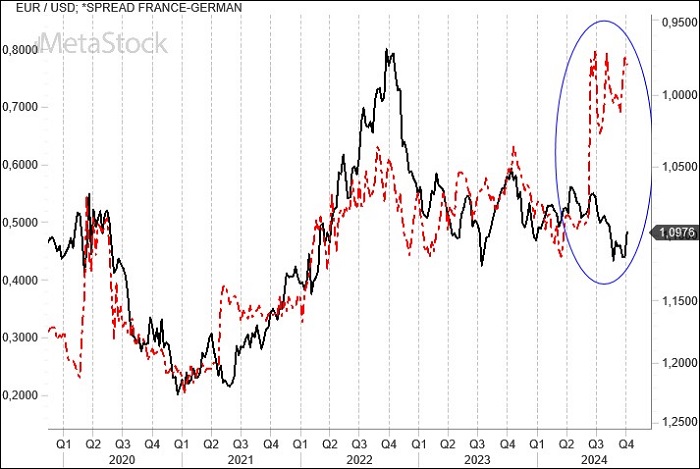

EUR/USD Weekly Outlook for December 9, 2024 – European Crisis Deepens as U.S. Economy Strengthens

The European political and economic crisis is worsening. Following Germany, France may also face new elections after the collapse of the Barnier government, or Macron will need to try to form a new government. This crisis contrasts with a U.S. economy that is thriving, which of course strengthens the U.S. dollar. However, technically, we still…

-

EUR/USD Weekly Outlook – December 2, 2024: Tariffs, Inflation, and Central Bank Decisions Shape the Path Ahead

The new American president, Trump, wasted no time in warning neighboring countries and China about upcoming tariffs on imports, at least until drug trafficking and illegal immigration into the US are halted. Meanwhile, in Europe, inflation is showing signs of awakening, reigniting concerns over the extent of the next ECB rate cut.

-

Weekly Eur/USD Outlook, November 25, 2024 – Dollar Strengthens as Geopolitical Tensions Weigh on Euro

Authorizing Ukraine to use Western weapons within Russian territory has fueled new geopolitical and military tensions. Following Trump’s victory, market preferences for gold and the dollar have intensified. The EUR/USD exchange rate has dropped below 1.05 in a context where central bank decisions continue to drive currency market dynamics.

-

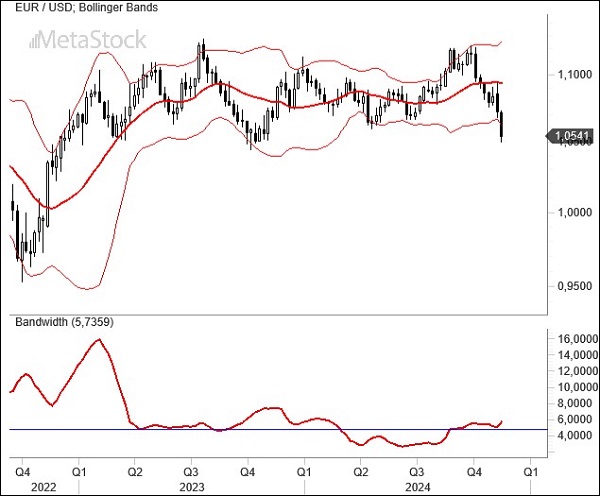

Weekly EurUsd Outlook for November 18, 2024 – Rising Volatility and the Looming Risk of Parity

Trump’s Election Boosts Dollar Amid Eurozone Weakness There is no doubt that Trump’s election has triggered substantial buying volumes for the U.S. dollar while driving sales of the euro and Japanese yen. Markets anticipate increased domestic investment (reflected in gains for small-cap stocks) at the expense of foreign investments, weighing heavily on European markets already…

-

Weekly EUR/USD Outlook – November 11, 2024 – Trump Victory Fuels Dollar Surge

Trump returns to the White House, confirming what markets had anticipated for a week: rising bond yields, stock markets at record highs, and a strong dollar. Meanwhile, the Fed cut rates as expected, though this might be its last move as inflation expectations grow among consumers and businesses. Germany, meanwhile, faces turmoil following the dismissal…

-

Weekly Outlook for November 4, 2024 – U.S. Election and Fed Decisions in Focus

EurUsd maintains its positions above the key support level of 1.08; however, the two main market movers will undoubtedly define the dynamics of the exchange rate in the coming days with greater precision.

-

Weekly Eur/Usd Outlook – October 28, 2024 – Election Uncertainty and Middle East Tensions Shake Markets

With Election Day just days away, the U.S. faces a close contest between Trump and Harris. The American economy is outperforming expectations, prompting the Fed to take a cautious approach on rate cuts. In contrast, the European Central Bank is pressured to cut rates further to address rapidly easing inflation and stagnating growth. Adding to…

-

Weekly EUR/USD Outlook October 21, 2024 – European Disinflation Accelerates as ECB Cuts Rates, Dollar Strengthens

Federal Reserve Urges Caution as ECB Cuts Rates, Euro Weakens This week, various Federal Reserve officials urged caution regarding interest rate cuts. Yes, cuts may come, but with careful consideration, always factoring in inflation trends and employment data. Consumer prices in September halted their deceleration, though the labor market appears unaffected for now. The two…

-

Weekly EUR/USD Outlook for October 14, 2024 – Rate Differentials & ECB Policy Set the Stage

Geopolitical tensions that persist globally do not appear to be disrupting financial markets, which are reaching new all-time highs in equities and showing less concern about an economic recession, at least in the United States, despite the resurgence of inflation. This week, the ECB is expected to cut interest rates, while EUR/USD seems to be…

-

Weekly EUR/USD Outlook for October 7, 2024 – Middle Eastern Conflict Bolsters Dollar as Inflation Declines in Europe

Geopolitical Tensions Lift Oil Prices, Strong U.S. Jobs Data Challenges Fed Rate Cuts Markets remain tense amid the wave of Middle Eastern war tensions. Israel’s attack on Lebanon and Iran’s retaliatory response on Israeli soil threaten to expand the conflict. However, markets have found some comfort in China’s decisive actions to combat the stagnation of…

-

Weekly Eur/Usd Outlook for September 30, 2024 – Euro Holds as U.S. Rate Cuts Loom

Global bond yields continue to compress, signaling that markets expect more accommodative policies from central banks. While Europe seems headed for recession, China is reviving its monetary and fiscal tools in an effort to escape an increasingly entrenched deflationary crisis.