-

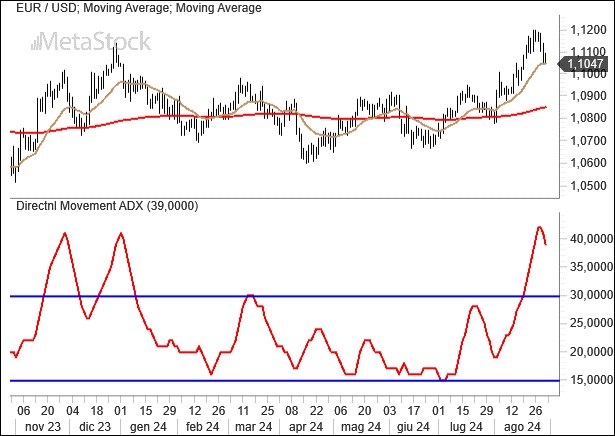

Weekly EUR/USD Outlook – September 23, 2024 – Fed’s Surprise Rate Cut

Fed’s Aggressive Rate Cuts Spark Debate as Economic Uncertainty Grows In alignment with bond market expectations, the Fed acted swiftly with a substantial 50 basis point rate cut, possibly aiming to make up for lost ground in August. The market now anticipates two additional 25 basis point cuts in the year’s final two meetings, scheduled…

-

Weekly EurUsd Outlook for September 16, 2024 – Central Banks Take the Stage Amid Key Resistance Levels

The dollar holds steady, and the euro fails to advance. This sums up a week in which the ECB fulfilled its promise to cut interest rates, while U.S. inflation, at 2.5%, set the stage for a similar move by the Fed in what will be the final meeting before the much-anticipated presidential elections in November.

-

EurUsd Weekly Outlook – September 9, 2024: Markets Brace for Fed and ECB Decisions

The dollar continues to remain weak ahead of the two central bank meetings (FED and ECB), which are expected to result in a new rate cut from the ECB and the start of an expansionary phase by the FED. The dollar is losing ground due to the prospect of a more decisive U.S. monetary policy…

-

Weekly EurUsd Outlook for September 2, 2024 – Dollar Resilience Amid Fed Rate Cut Expectations

The resilience of the dollar seems to be the dominant theme as August comes to a close, with the Fed making it clear that rate cuts will occur before the November presidential elections. The greenback has held its ground, avoiding a breach of key technical levels against both the euro and the yen. Meanwhile, in…

-

Weekly EurUsd Outlook for August 26, 2024 – Dollar Freefall Amid Powell’s Rate Cut Signal

Markets are in sync with Powell and the Fed, as Jackson Hole saw the announcement that the time for rate cuts has arrived. The U.S. economy is slowing down, job creation is falling short of estimates, and inflation is gently retreating. A similar situation is unfolding in Europe, but it was enough for the stock…

-

Weekly EurUsd Outlook for August 12, 2024 – Fed Holds Steady Amid Market Volatility

Market Volatility Rises Amid Geopolitical Tensions and Fed Speculation Markets remain highly volatile across both bond and equity sectors. Geopolitical tensions, combined with shifts in speculative carry trade positions and uncertainty surrounding upcoming U.S. macroeconomic data, are driving a cautious approach. The market appears to have moved too aggressively in predicting a 125 basis point…

-

Weekly EurUsd Outlook for August 5, 2024 – Markets Anticipate Fed & ECB Rate Cuts Amid Economic Uncertainty

Fed Defers Rate Decision to September Amid Rising Employment Concerns The Federal Reserve has kept interest rates unchanged as expected, deferring any decisions to September, contingent on upcoming data confirming the rising inflation trend seen so far. Consequently, the market has responded by further lowering long-term interest rates, convinced that there will be multiple rate…

-

Weekly EurUsd Outlook for July 29, 2024 – Rising Volatility and Political Shifts Shape Market Trends

After Biden’s withdrawal from the race for the White House, the electoral contest will be Harris versus Trump until November. Meanwhile, markets are in turmoil due to lackluster quarterly data, the Chinese crisis, and the strengthening yen. All these factors have increased market volatility, but not for EurUsd.

-

Weekly EurUsd Outlook for July 22, 2024 – Fed & ECB Rate Cuts on the Horizon, Biden Withdraws

Biden has decided to step back from the presidential race, and this event, following the attack on Donald Trump, further fuels uncertainty about the outcome of the November election. Meanwhile, the market is convinced of a Fed Funds rate cut in September. The ECB remains on standby, announcing a possible move in September if inflation…

-

Weekly EurUsd Outlook July 8, 2024 – French Vote Shakes Markets

The French elections seem to have almost benefited the euro, which had dangerously approached critical support levels. The prospect of political stagnation combined with uncertainties on the American electoral front, as well as a certain stand-by on interest rates, help to keep the trading range on EurUsd active.

-

Weekly EurUsd Outlook for July 1, 2024 – Eurozone Risks Overlooked Amid Market Highs & Political Uncertainties

Key Events Impacting Markets: Trump-Biden Debate and French Election Last week was largely influenced by two main events: the first Trump-Biden debate and anticipation for the French election, where Macron’s tenure at the Élysée is at stake. The final round of the French election will be on July 7, but the current state of tension…

-

EurUsd Weekly Outlook June 24, 2024 – Euro Tensions and Dollar Dynamics

French Elections and the Fed Under Scrutiny France remains at the forefront with its political crisis, expected to be resolved soon with the upcoming political elections. Currently, the euro is experiencing some pressure, though it is relatively mild. The spread between France and Germany has surged beyond 70 basis points, the highest in the last…