- Fed Chair Powell holds his ground, reaffirming the Federal Reserve’s independence from political pressure despite renewed criticism from President Trump. With employment still robust and inflation under upward pressure from tariffs, the Fed is opting for a wait-and-see approach. A trade deal with China now appears to be within reach.

- Germany ushers in a new era with Friedrich Merz as Chancellor, facing complex geopolitical and economic challenges. Meanwhile, there are tentative signs of an economic rebound in Europe. The UK has finalized a tariff agreement with the U.S.

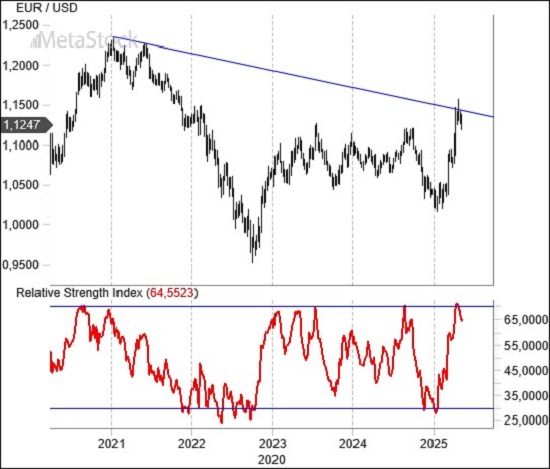

- EUR/USD remains in a corrective phase, consolidating after April’s strong move. The pair is trading in the upper part of a range that likely spans 1.10 to 1.14 in the weeks ahead.

Powell Holds Steady as Markets Turn to Trade Talks

With the statement, “We believe our current stance positions us well to respond promptly to potential new developments,” Federal Reserve Chair Jerome Powell signaled no imminent interest rate changes, reinforcing the Fed’s independence from political interference. The move comes despite sharp criticism from Trump.

The federal funds rate remains steady in the 4.25%–4.50% range, supported by resilient labor market data and only modest signs of inflation resurgence, largely attributed to tariff pressures. Powell’s measured tone reassured investors, triggering little market volatility. The dollar, however, gained modestly.

Attention now shifts to ongoing trade negotiations led by the Trump administration. Following talks with newly elected Canadian Prime Minister Mark Carney, meetings with a Chinese delegation in Switzerland have rekindled hopes of de-escalation with Beijing. Broader trade discussions continue with both developed and emerging economies, alongside talks on longstanding geopolitical flashpoints such as Ukraine and the Middle East—and newer concerns like India-Pakistan tensions.

A preliminary trade deal has been signed with the UK, but given the balanced trade relationship between the two countries, its impact is expected to be limited.

New German Leadership and Eurozone Data Spark Hopes of Recovery

In Europe, the political landscape shifts as Friedrich Merz takes office as German Chancellor. Tasked with steering the EU’s largest economy through mounting uncertainty, Merz’s leadership will be tested in coming weeks as markets watch for signals on his domestic and EU-level strategies.

Meanwhile, recent PMI data suggests the beginning of a recovery in the eurozone. April’s composite reading climbed above the 50-point threshold—an early sign that capital may be rotating away from U.S. markets toward Europe, potentially supporting the euro in the medium term.

Technical Analysis: EUR/USD Overbought but Bullish Setup Holds

Despite remaining firm, the EUR/USD is showing signs of fatigue. Following April’s bullish surge, the pair has entered a corrective phase, hovering below key resistance levels. Weekly technicals indicate overbought conditions, which historically precede local peaks.

In the short term, some pullback is expected, with the 1.12 zone likely offering the first level of support against further declines.

While short-term pressure on the euro is possible, the broader outlook remains constructive. A key technical indicator, the monthly MACD, is showing signs of crossing above zero—historically a bullish signal for the euro.

This pattern previously appeared in 2017 and 2020, where a brief pause was followed by renewed strength and higher highs. If history repeats, EUR/USD could be setting the stage for another leg higher in the coming months.

Leave a Reply

You must be logged in to post a comment.