Tag: Trump

-

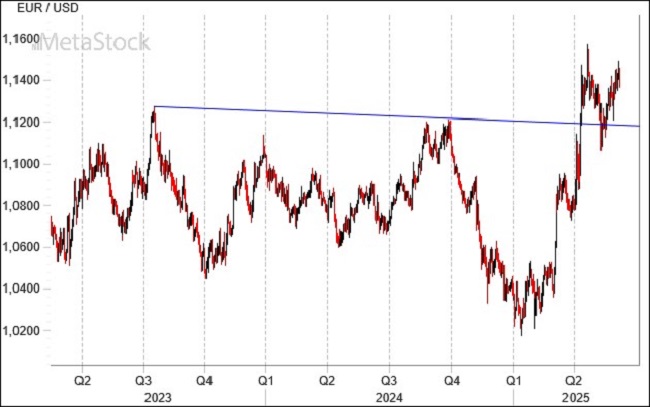

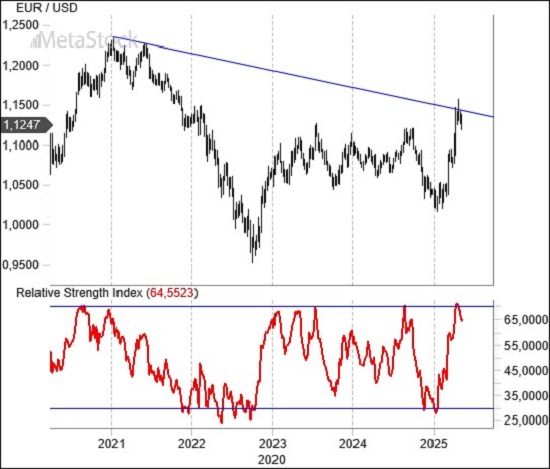

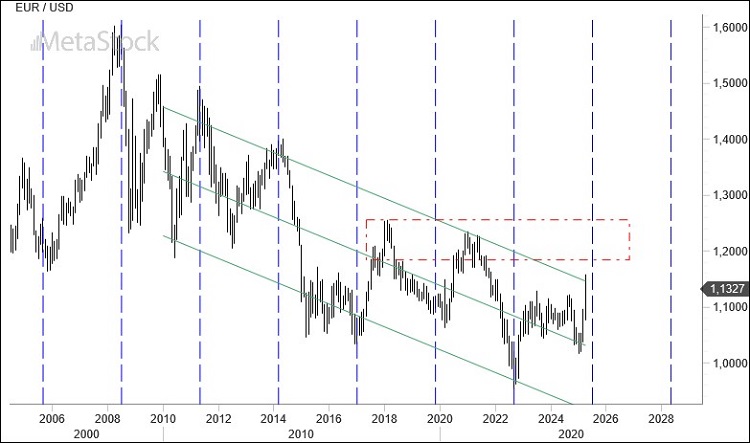

Weekly EUR/USD Outlook, July 14, 2025: Trade Tensions Resurface as 1.20 Comes into View

The trade war returns to center stage. With the suspension window now closed, the White House has begun sending letters to every country that failed to agree to its proposed trade deals. Nations like Brazil now face tariffs of 50%, Japan 25%, and Canada 35%. In response, the Fed is taking a cautious stance on…

-

Weekly EUR/USD Outlook, July 7 2025: Trump-Powell Rift Deepens as Euro Targets 1.20

The trade war may be dormant, but it’s far from over—and in the meantime, a war of words is heating up in the U.S. between Trump and Powell. The latter, aware of the need to ease borrowing costs for the American economy, stated that interest rates would already be lower if tariffs weren’t in place.…

-

EUR/USD Weekly Outlook, June 30, 2025 -Euro Eyes 1.20 as Dollar Slides on Middle East Truce and Fed Shake-Up

The war between Israel and Iran already appears to be over, with the announcement of a ceasefire bringing renewed calm to markets and oil prices—while pushing the dollar even lower. Meanwhile, Trump has begun his search for Powell’s replacement at the Fed, and markets are now pricing in a rate cut as early as September,…

-

EUR/USD Weekly Outlook, June 24, 2025 – War Tensions Offer Little Support to the Dollar

The EUR/USD remains under pressure as geopolitical tensions, notably the Israel-Iran conflict, overshadow market hopes for U.S. rate cuts. With the Federal Reserve holding firm and oil prices elevated, the dollar draws strength from global uncertainty, while technical indicators hint at possible consolidation before any decisive move.

-

Weekly EUR/USD Outlook – June 9, 2025: Dollar Weakens as ECB Cuts Rates and Trump Tensions Mount

The ECB followed through on expectations, cutting rates while taking comfort in inflation that shows no signs of reigniting. In the U.S., the latest employment data confirmed the underlying strength of the American economy, though wage pressures are once again creeping higher. The EUR/USD remains firmly supported, hovering near key resistance levels that could prove…

-

EUR/USD Weekly Outlook, June 2, 2025 – Tariff Turmoil, Euro Optimism, and a Stalled Breakout

A surprise court ruling declaring Trump-era tariffs illegal has thrown a wrench into U.S. trade policy. The decision, which briefly cast doubt over the administration’s legal footing, was quickly overturned on appeal. Markets and the dollar wavered amid the uncertainty—but Trump seized the moment to escalate further, announcing a doubling of tariffs on steel and…

-

Weekly EUR/USD Outlook, May 26, 2025: Rising Yields and Market Reactions Amid U.S. Debt Downgrade

The U.S. credit rating downgrade continues to have negative effects on the bond market, with long-term yields globally starting to rise again. U.S. debt is worrying the bond market, as well as the dollar, which struggles to break through key support levels against the euro. Meanwhile, Trump threatens Europe with 50% tariffs.

-

Weekly EUR/USD Outlook, May 12, 2025: U.S.Fed Patience, Trade Talks, and Eurozone Hopes

The Fed holds rates steady, with Chair Powell emphasizing the central bank’s independence and a patient stance, as current economic conditions do not warrant immediate action. Meanwhile, the Trump administration continues its tariff negotiations, sealing an initial deal with the UK and signaling a compromise with China. In Europe, Friedrich Merz has taken office as…

-

EUR/USD Weekly Outlook, May 5, 2025: Recession Hits U.S. as Euro Finds Breathing Room

The U.S. economy slipped into reverse in the first quarter of 2025, with inflation ticking higher. That was the key message from the latest GDP release, as a surge in imports weighed heavily on growth. In Europe, inflation remains subdued, giving the euro a chance to regroup after its sharp rally in recent weeks amid…

-

Weekly EUR/USD Outlook, April 28, 2025: Trump’s Shift Eases Volatility, Dollar Remains Under Pressure

Trump seems to have recognized that pulling too hard risks breaking the rope — with equity, bond, and currency markets serving as clear indicators of mounting uncertainty. His partial retreat on China and Fed policy has given markets some breathing room, though the dollar remains under persistent pressure.