Category: Global

-

Weekly EUR/USD Outlook, December 1: The Dollar Enters Its Toughest Month

America heads into Thanksgiving with inflation appearing to cool, but also with a labor market showing signs of uncertainty. That combination is likely to push the Federal Reserve toward a rate cut on December 10, just as the race to succeed Powell begins. For EUR/USD, December is shaping up to be one of the strongest…

-

EUR/USD Weekly Outlook, September 29 2025: Dollar Struggles on Fed Caution, Geopolitical Risks

The currency market remains stuck. After its recent rate cut, the Fed is preaching caution, citing inflation risks and tariff pressures. The White House, meanwhile, is loudly pushing for lower borrowing costs while reigniting the trade tariff debate. In Europe, growth is stagnant, and the possibility of an escalation with Russia can no longer be…

-

Weekly EUR/USD Outlook for February 3, 2025 – Fed Holds Steady, ECB Cuts Rates Amid Economic Uncertainty

As the clash between the Fed and Trump intensifies, Governor Powell stays the course, communicating to the markets that now is not the time to cut interest rates. Inflation and economic conditions do not support such a move, with the uncertainty of tariffs looming, becoming reality starting in February. Exactly the same reasons, but in…

-

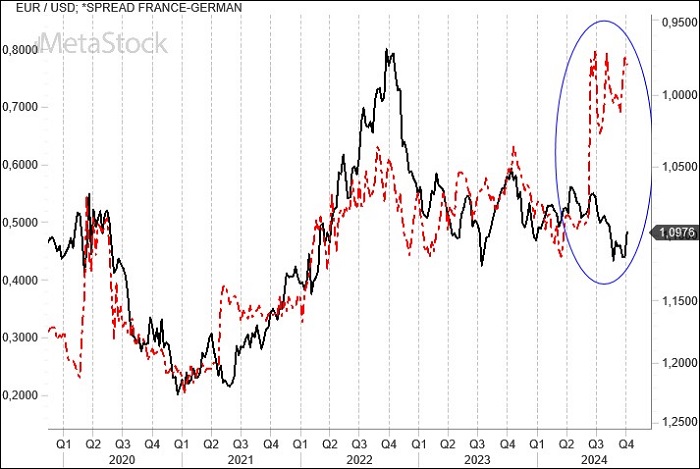

EUR/USD Weekly Outlook, January 6, 2025 – Gas Crisis and Interest Rates Impacting the Euro

The gas war reignites tensions over energy prices in Europe and also puts pressure on the euro, whose performance is hindered by political concerns in key countries like France and Germany, as well as macroeconomic data that continues to offer little reassurance regarding recovery. Meanwhile, expectations grow for Trump’s inauguration at the White House.

-

2025 EurUsd Outlook – What Does the New Year Hold for the Euro and Dollar?

A 2025 filled with both certainties and uncertainties is about to unfold. The United States, Europe, China, wars, inflation, and interest rates will continue to drive content and volatility in markets that, in 2024, delivered robust performance in equities, stagnation in bonds, and a strong dollar, fueled by significant economic and interest rate differentials between…

-

EUR/USD Weekly Outlook for December 9, 2024 – European Crisis Deepens as U.S. Economy Strengthens

The European political and economic crisis is worsening. Following Germany, France may also face new elections after the collapse of the Barnier government, or Macron will need to try to form a new government. This crisis contrasts with a U.S. economy that is thriving, which of course strengthens the U.S. dollar. However, technically, we still…

-

Weekly Eur/Usd Outlook – October 28, 2024 – Election Uncertainty and Middle East Tensions Shake Markets

With Election Day just days away, the U.S. faces a close contest between Trump and Harris. The American economy is outperforming expectations, prompting the Fed to take a cautious approach on rate cuts. In contrast, the European Central Bank is pressured to cut rates further to address rapidly easing inflation and stagnating growth. Adding to…

-

Weekly EUR/USD Outlook for October 7, 2024 – Middle Eastern Conflict Bolsters Dollar as Inflation Declines in Europe

Geopolitical Tensions Lift Oil Prices, Strong U.S. Jobs Data Challenges Fed Rate Cuts Markets remain tense amid the wave of Middle Eastern war tensions. Israel’s attack on Lebanon and Iran’s retaliatory response on Israeli soil threaten to expand the conflict. However, markets have found some comfort in China’s decisive actions to combat the stagnation of…

-

Weekly Eur/Usd Outlook for September 30, 2024 – Euro Holds as U.S. Rate Cuts Loom

Global bond yields continue to compress, signaling that markets expect more accommodative policies from central banks. While Europe seems headed for recession, China is reviving its monetary and fiscal tools in an effort to escape an increasingly entrenched deflationary crisis.

-

Weekly EUR/USD Outlook – September 23, 2024 – Fed’s Surprise Rate Cut

Fed’s Aggressive Rate Cuts Spark Debate as Economic Uncertainty Grows In alignment with bond market expectations, the Fed acted swiftly with a substantial 50 basis point rate cut, possibly aiming to make up for lost ground in August. The market now anticipates two additional 25 basis point cuts in the year’s final two meetings, scheduled…