Category: Economic Indicators

-

Weekly EurUsd Outlook, April 29, 2024 – Europe Poised to Capitalize as U.S. Growth Slows

Interest Rate Strategies Amid Economic Shifts Markets have a fairly clear idea of what should happen with interest rates. The ECB might cut rates once or twice in 2024, with the first move expected in June, while the Fed might only adjust monetary policy by late 2024 if inflation slightly recedes from current levels and…

-

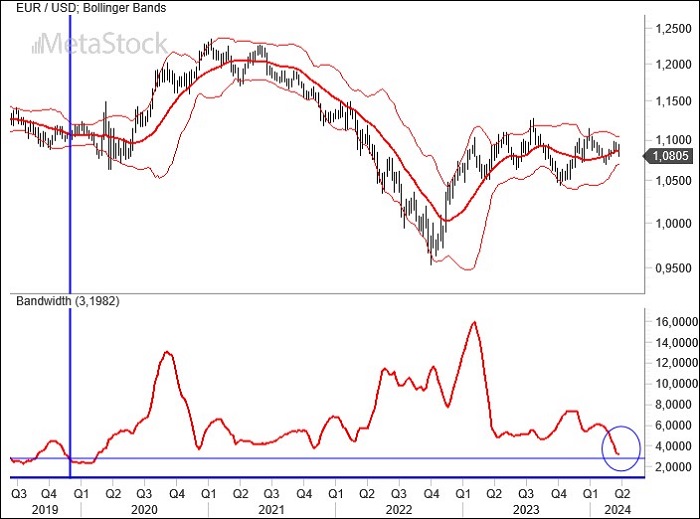

EurUsd Weekly Outlook, April 22, 2024 – Diverging Monetary Paths and the Test at 1.05

The monetary policies of the Federal Reserve and the European Central Bank are heading in opposite directions. Jerome Powell has adopted a more hawkish stance than Christine Lagarde, pushing up U.S. interest rates and bolstering the dollar, which is further favored by an increasingly tense geopolitical climate. The widening gap between the growth and expected…

-

Weekly EurUsd Outlook for April 15, 2024 – U.S. Inflation Climbs, ECB Holds Rates

March U.S Inflation Fuels Economic Uncertainty Amid ECB Caution March’s eagerly awaited U.S. inflation data showed a significant rise, particularly in petroleum products, setting the stage for an increase in the headline CPI to 3.5%. The core rate, stripped of volatile components, exceeded expectations at 3.7%. Recent remarks from central bankers, focusing largely on unexpectedly…

-

UBS Updates Year-End S&P 500 Target to 5,500 Amid Strong Economic indicators

In a recent market analysis report, UBS has adjusted its year-end target for the S&P 500 to 5,500, up from its previous estimate of 5,200. This revised forecast comes as U.S. equities continue to experience robust growth, supported by solid earnings performances and significant investments in artificial intelligence (AI). For the first quarter of 2024,…

-

EurUsd Weekly Outlook, April 8, 2024 – Crosscurrents of Global Monetary Policies

Powell plays the firefighter and urges caution on rate cuts. The American economy continues to produce encouraging data, including on the employment front, causing stock markets to halt their gains while bond yields rise. The dollar attempts an assault on the euro, where inflation is increasingly contracting, but without success. The EurUsd supports hold steady…

-

Weekly EurUsd Outlook for April 1, 2024 – Navigating Uncertainty with Interest Rates and Currency Pressures

In a week scarce on data, Powell toned down the dovish remarks that emerged from the last FOMC meeting, indicating that if inflation does not decrease, rates will remain high for longer. This was confirmed by the Fed Chair, who suggested that it is unlikely we will see interest rates return to pre-pandemic levels. The…

-

EurUsd Weekly Outlook, March 25, 2024 – The Fed Fuels Market Fire

According to the Fed, there seem to be no major issues in managing inflation, even in a context of upwardly revised economic growth that still promises demand-side pressures. Powell believes there’s no need to tighten further, with the Dot Plots indicating three rate cuts for the current year. The dollar is holding its ground, confirming…

-

Weekly EUR/USD Outlook for March 11, 2024 – Navigating Rate Cuts and Economic Signals

Powell, speaking before Congress, confirmed what the markets wanted to hear. Rates will decrease over the course of 2024, although the pace will depend on inflation and its resilience. Meanwhile, the ECB keeps rates unchanged in the March meeting, and the euro strengthens above the key support levels of 1.08.

-

EurUsd Weekly Outlook for March 4, 2024 – Navigating the Tides of Central Bank Rhetoric and Market Optimism

Fed Rate Cuts, Robust Growth, and Political Dynamics Once upon a time, there were anticipated rate cuts promised by the Fed. With each passing week, expectations for a reduction in the cost of money have shrunk, and as of today, the market anticipates a cut of 75 basis points by the end of 2024, down…

-

EurUsd Weekly Outlook for February 26, 2024 – Navigating Through Low Growth, Rate Expectations, and Seasonal Trends

Few news are coming from the United States where the market is becoming more realistic about the evolution of monetary policy. Amid alternating statements from various central bankers, the market has acknowledged that there will be no reductions in the cost of money before summer. Meanwhile, in Europe, all growth estimates have been revised downwards,…