- Mixed economic signals in the United States set the stage for what is widely expected to be a rate cut by the Federal Reserve this week. Markets are looking for clearer guidance on the outlook for 2026, when Chair Jerome Powell is scheduled to step down and hand over leadership to a successor seen as more closely aligned with former President Donald Trump.

- Across the Atlantic, eurozone macro data surprised to the upside, with inflation ticking higher. Against this backdrop, the European Central Bank is expected to hold rates steady, deeming current levels appropriate for today’s economic environment.

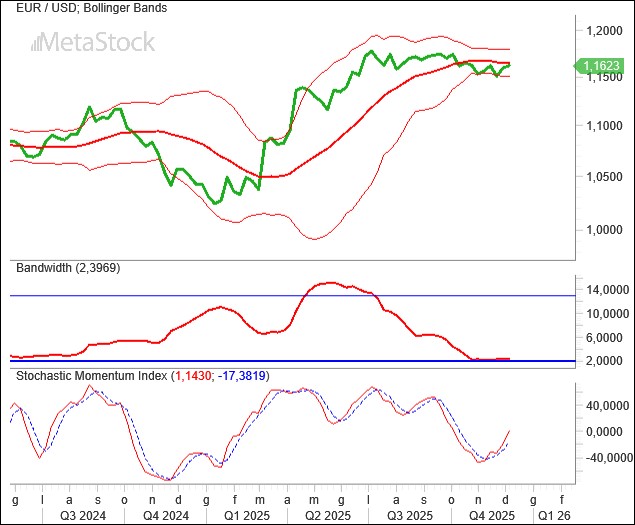

- Meanwhile, EUR/USD has begun edging away from the 1.15 support area, inching toward the key 1.19 resistance zone, helped in part by the dollar’s typically soft December seasonality.

A Growth Picture Still Lacking Clear Resolution

The Fed’s upcoming rate cut is surrounded by uncertainty about what comes next—specifically, whether policy easing will extend meaningfully into 2026. After weeks of partial data blackouts caused by the government shutdown, the return of macro releases and a series of mixed comments from Fed officials have revived speculation that the central bank might opt for a prolonged pause, possibly through May, when Powell leaves the chairmanship.

Long-term yields, which have been unable to break below the 4% threshold, reinforce the idea that markets may be bracing for a more cautious Fed.

The macro backdrop is uneven. The ISM services index surprised to the upside, confirming ongoing resilience in the services sector and showing further cooling in the prices-paid component. But the ISM manufacturing survey told a very different story, falling to a six-month low, while industrial production also disappointed. Despite higher tariffs, there’s little evidence that U.S. manufacturing has been revived.

Weekly jobless claims suggest the labor market is not under significant stress. Yet inflation remains sticky: the November PCE reading came in at 2.8%, with the core measure also rising 2.8%, underscoring how difficult the final leg back to 2% may be.

In Europe, forward-looking PMI indicators climbed well above the 50-point threshold, and inflation unexpectedly rose to 2.2%. These developments all but confirm that the ECB will hold interest rates steady for now.

The combination of U.S. uncertainty and a modestly improving European growth profile has pushed investors back toward the euro, with EUR/USD attempting to retest resistance levels.

Dollar Weakness Returning?

Seasonality, the anticipated Fed cut, the prospect of more dovish leadership in 2026, and the massive fiscal deficits Washington must contend with all weigh against a bullish dollar outlook. For now, there is little compelling rationale for investors to take long positions in the greenback.

Weekly volatility remains unusually compressed, as shown by the narrowing Bollinger Bands. A meaningful breakout would likely require a move above 1.18 or below 1.15—levels traders are watching closely for signs of directional conviction.

Momentum indicators appear to be leaning higher. The SMI oscillator points to a potential upward move that could allow the euro to challenge the 1.19–1.20 region, now within easier reach thanks to a more balanced sentiment between the two currencies.

The daily EUR/USD chart offers a clearer view of the market’s intentions. The pair has already broken above a short-term downtrend line, completing a bullish head-and-shoulders pattern that could carry it toward 1.18 in the sessions ahead—assuming the Fed doesn’t disrupt the setup.

A push to that level would also invalidate the previously forming medium-term bearish head-and-shoulders structure, opening the door for the euro to aim for new highs. In that scenario, 2026 could shape up as a year in which the single currency delivers a decisive blow to the U.S. dollar.

The recent price action suggests early fractures appearing in the resistance zone, reinforcing the view that the euro may soon gather enough momentum for another test of the 1.19 area.

Leave a Reply

You must be logged in to post a comment.