- Weak U.S. employment figures are set to force Powell’s hand on interest rates. A slight uptick in the ISM manufacturing index offers little comfort, as inflation fears linger, driven in part by tariffs whose full effects have yet to be felt.

- Europe remains at the center of investor attention as political turmoil in France rattles markets. Despite President Macron’s efforts to maintain diplomatic momentum on Ukraine, domestic instability is mounting.

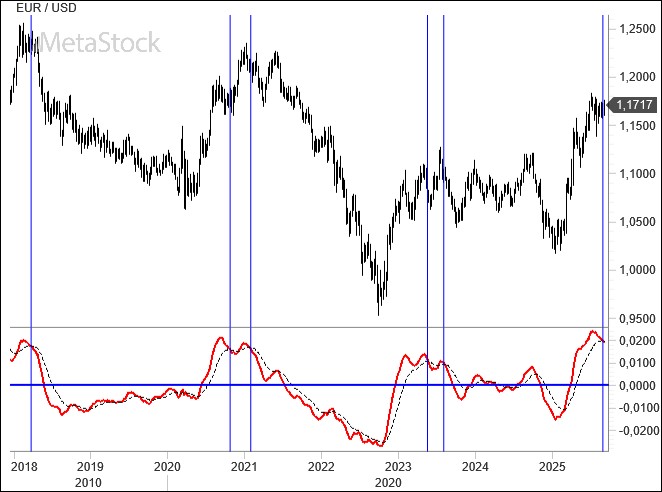

- EUR/USD hovers just below critical resistance levels as markets await clarity from the Fed. A breakout above 1.18 would open the door to significant upside potential for the euro.

U.S. Jobs Market Hits a Wall

The week’s pivotal release came from the U.S. labor market—and it disappointed. Just over 20,000 new jobs were created, while the unemployment rate climbed to its highest since late 2021. The White House, eager for evidence of a slowdown driven by high rates, found just that. With tariffs largely left out of the official narrative, the September FOMC meeting now appears locked into delivering a rate cut.

The ISM manufacturing index offered a mixed signal: still below 50 but slightly higher, with new orders improving even as employment remained weak. Together, these data reinforce expectations for a 25-basis-point cut. Powell’s inflation concerns haven’t vanished, however, as the prices sub-index remains elevated.

Comparing the Dollar Index with 10-year Treasury yields highlights investors’ fading appetite for the greenback. Even with nominal yields still above 4%, the dollar has fallen more sharply than expected. Yield spreads with European sovereign debt have narrowed, but not enough to fully justify EUR/USD’s current position—suggesting markets are factoring in more than just rates.

In Europe, all eyes are on France, where a looming confidence vote could reshape the country’s political landscape. Macron continues to push for diplomatic initiatives on Ukraine, but the risk of new elections is undermining Paris’s credit outlook—a factor future governments, whatever their composition, will not be able to ignore.

Technical Analysis: EURUSD Testing the Fed’s Resolve

Revisiting last week’s chart underscores how volatility is tightening. The pair is trapped between descending highs that define resistance and the 50-day moving average, which has held the line above 1.16 since August. The key range lies between 1.175, tested last Friday, and 1.16. A breakout from this zone would carry significant bullish or bearish implications for the months ahead, with the bias tilting toward the upside.

Weekly indicators paint a more cautious picture. The MACD oscillator has turned lower, a signal that in recent years has typically marked the strongest phases for the dollar. A sustained euro rally above 1.20 would be a surprise under these conditions. More likely is a sideways consolidation that allows technicals to reset. Only if the 1.14 support breaks would the dollar regain more compelling momentum.

Leave a Reply

You must be logged in to post a comment.