- Powell’s assertive remarks, embodying a hawkish approach, emphasize the continued need for aggressive interest rate measures to curb inflationary pressures. The Federal Reserve’s objective of managing a controlled economic downturn while mitigating inflationary risks is yet to be fully realized.

- Similarly, the Eurozone has not reached the culmination of its interest rate hike cycle. An additional rate increase is expected in July, followed by a potential final adjustment in the fourth quarter. However, the success of these measures relies on the inflation trajectory aligning with desired targets and the economy avoiding unexpected deceleration.

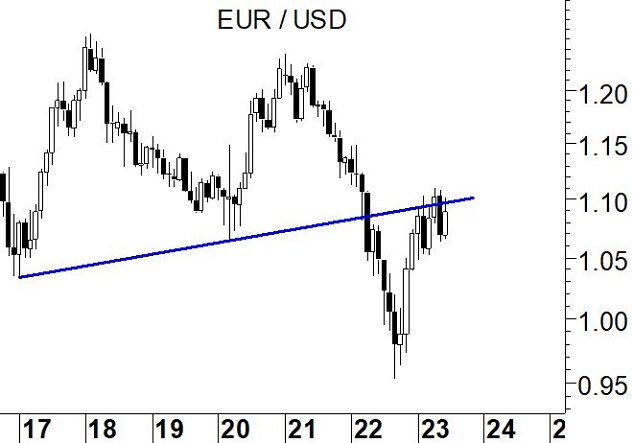

- Currently, the EUR/USD exchange rate has reached the 1.10 level after demonstrating resilience and rebounding from support levels. Going forward, the critical resistance levels will play a decisive role in curbing the euro’s momentum. Any breakthrough to the upside could present significant opportunities for the European currency.

Persistent Inflationary Challenges

The recent surge in short-term US interest rates reflects the Federal Reserve’s increasingly hawkish stance. This trajectory is consistent with the global trend, as other countries such as the United Kingdom, Switzerland, and Norway have also implemented interest rate hikes to counter inflationary pressures. The UK’s experience serves as a potential indicator of what might transpire in the United States shortly, with consumer prices exhibiting resistance to downward pressure and with the latest data revealing a shocking 30-year high for core inflation, reaching 7.1%.

Within the Eurozone, an interest rate hike in July is widely anticipated. However, there is a significant likelihood that ECB president Lagarde will enact further tightening measures in the final quarter, potentially driving the rate to 4%, conditional on the economy avoiding unanticipated slowdowns. The recent PMI data revealed a greater-than-expected downturn, exacerbating the challenge posed by higher borrowing costs for consumers and businesses across the Eurozone.

The evolving situation in Russia warrants careful observation as it could reshape the landscape in the coming weeks.

The Curious Case of the Unresponsive Dollar

The US dollar’s limited response, relative to the magnitude of interest rate hikes, has confounded market expectations. Since the first rate hike in March 2022, the dollar’s appreciation has been modest, despite a substantial increase of 500 basis points within a short timeframe. For instance, the Dollar Index stood just above 98 in early spring 2022 and currently hovers around 103. This illustrates the difficulty of making accurate predictions regarding currency movements based solely on interest rate dynamics. Notably, currency appreciation does not always align with higher-than-anticipated rate hikes. Remarkably, the period between 1999 and 2000 witnessed a similarly modest dollar appreciation. Nevertheless, the technical support level observed in the Dollar Index around the 100 mark could serve as a pivotal launching point for the greenback’s recovery. In the event of a triple bottom pattern, astute traders seeking opportunities within a highly liquid and widely traded currency may find it advantageous to consider this option. Conversely, a decline below this level would significantly alter the outlook for the US dollar, warranting a highly recommended course of action: the closure of all long positions.

In the aftermath of the bearish market-wide reversal witnessed in May, the Euro is putting up a vigorous response. It’s difficult to dismiss the importance of resistance levels residing between 1.10 and 1.12, as they stand as a critical safeguard for future scenarios.

Previously in February, the bearish market-wide reversal effectively fended off advances, hinting that a triumphant upward breakout could generate sufficient momentum to approach levels just shy of 1.18/1.20. Nevertheless, this obstacle seems persistently formidable to overcome.

Leave a Reply

You must be logged in to post a comment.