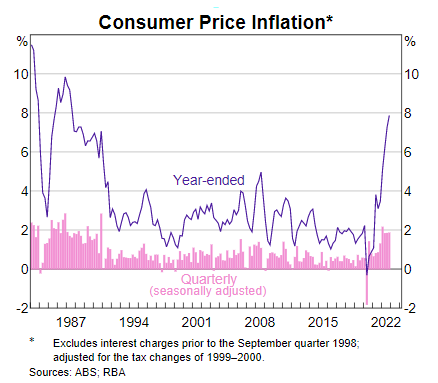

In a statement released on 2 May 2023, Philip Lowe, Governor of the Reserve Bank of Australia (RBA), announced that the Board has decided to increase the cash rate target by 25 basis points to 3.85%. The rate paid on Exchange Settlement balances has also been increased by 25 basis points to 3.75%. This decision comes as inflation remains high at 7%, and the Board is determined to bring it back to the target range within a reasonable timeframe.

Despite a decline in inflation, the central forecast suggests it will take a couple of years before it returns to the top of the target range. Goods price inflation is slowing due to improved supply and demand balance following the resolution of the pandemic disruptions, but services price inflation remains high with upside risks. Unit labour costs are also rising, with subdued productivity growth.

The Australian labour market is very tight, with unemployment at a near 50-year low. Many firms are experiencing difficulty hiring workers, although there has been some easing in labour shortages, and the number of vacancies has declined slightly.

The RBA’s priority is to return inflation to target, as high inflation can negatively impact the economy and people’s lives. The Board aims to keep inflation expectations well anchored, and today’s adjustment in interest rates will contribute to this goal. Wages growth has increased in response to the tight labour market and high inflation, but it is still consistent with the inflation target as long as productivity growth picks up.

The central forecast predicts the Australian economy will continue to grow at a below-trend pace, with GDP increasing by 1¼% this year and around 2% over the year to mid-2025. The unemployment rate is expected to increase gradually to around 4½% by mid-2025.

Uncertainty remains regarding the outlook for household consumption, which is being affected by higher interest rates, cost-of-living pressures, and the earlier decline in housing prices. The global economy is also uncertain, as it is expected to grow at a below-average rate over the next couple of years.

The RBA may further tighten monetary policy to ensure that inflation returns to target within a reasonable timeframe, but this will depend on the economy and inflation’s evolution. The Board will monitor developments in the global economy, household spending trends, and the outlook for inflation and the labour market, remaining determined to achieve their inflation target.

Leave a Reply

You must be logged in to post a comment.