Central banks worldwide are in the spotlight this week, as investors eagerly anticipate policy-setting meetings from the Federal Reserve and the European Central Bank (ECB). Market participants will also be closely watching the monthly U.S. jobs report and other key economic indicators for insights into the health of the global economy.

The Federal Open Market Committee’s (FOMC) upcoming meeting is expected to conclude with a 25 basis point increase in the benchmark lending rate target on Wednesday. This would mark the 10th consecutive rate hike since March 2022. However, recent first-quarter growth figures have pointed to a rapidly slowing economy, suggesting that this may be the end of the Fed’s tightening cycle.

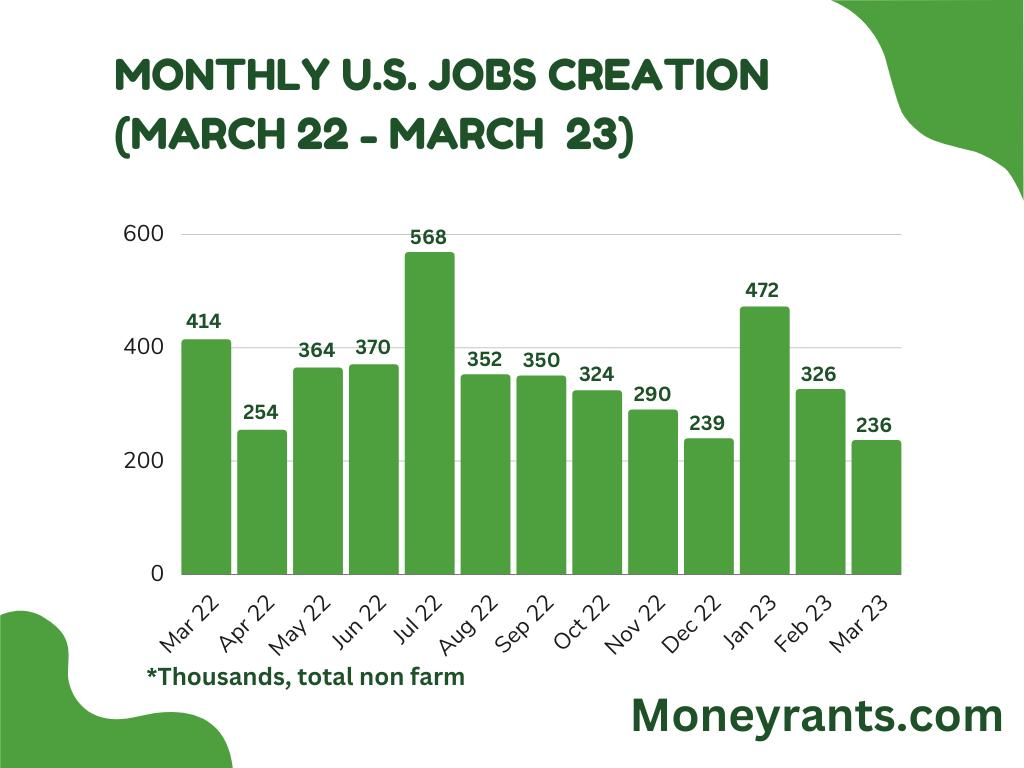

At the end of the week, the release of the U.S. jobs report is expected to show the economy added 180,000 jobs. While this is still a solid number, it would signify a third consecutive month of moderating job growth, further highlighting the potential need for a shift in monetary policy.

The European Central Bank (ECB) is also slated to meet this week, with policymakers expected to approve another rate hike. The size of the increase remains uncertain, with Tuesday’s eurozone consumer price inflation data potentially playing a deciding role. If underlying price pressures remain uncomfortably high, a rate hike of 50 basis points could be on the table.

However, if bank lending data reveals that credit conditions have tightened significantly, a smaller rate hike might be considered more appropriate. The Bank of England is also expected to adopt a more aggressive stance than the Federal Reserve in the coming months, as central banks worldwide grapple with rising inflation and other economic challenges.

As markets await these central bank policy decisions and key economic data releases, investors remain vigilant for any signs of changes in monetary policy that may impact global economic trends and asset valuations in the short term.

Leave a Reply

You must be logged in to post a comment.