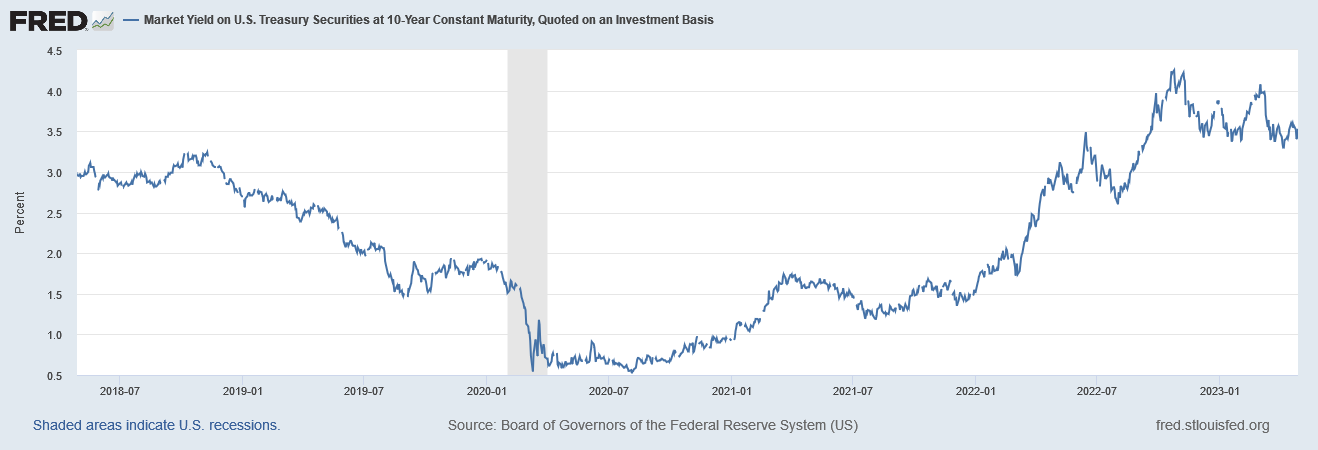

The Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity is a key financial indicator, serving as a benchmark for long-term interest rates and offering valuable insights into the health of the economy and credit markets. This measure reflects the yield on a hypothetical U.S. Treasury security with a fixed maturity of 10 years, providing a crucial insight into investor sentiment. U.S. Treasury securities, which come in various forms, are debt instruments issued by the United States Department of the Treasury to fund federal operations, public projects, and programs. These securities are considered one of the safest investments globally, backed by the full faith and credit of the U.S. government.

This comprehensive article, “10-Year Treasury Yield: Insights, Data & Market Implications“, provides an in-depth analysis of the fluctuating yield on the 10-Year U.S. Treasury Securities from 2018 to 2023. By exploring the dynamics behind these changes, it aims to offer readers an understanding of the impact of economic conditions, monetary policy, and investor sentiment on these key financial instruments. The article not only breaks down the different types of U.S. Treasury securities but also discusses the various factors influencing the 10-year constant maturity yield. This makes it a valuable resource for investors, financial professionals, and anyone interested in gaining a deeper understanding of the financial markets. Whether you’re a seasoned investor or a newcomer to the field, this piece offers significant insights into the workings of one of the world’s most important economic indicators, serving as a guide to making informed financial decisions.

Leave a Reply

You must be logged in to post a comment.