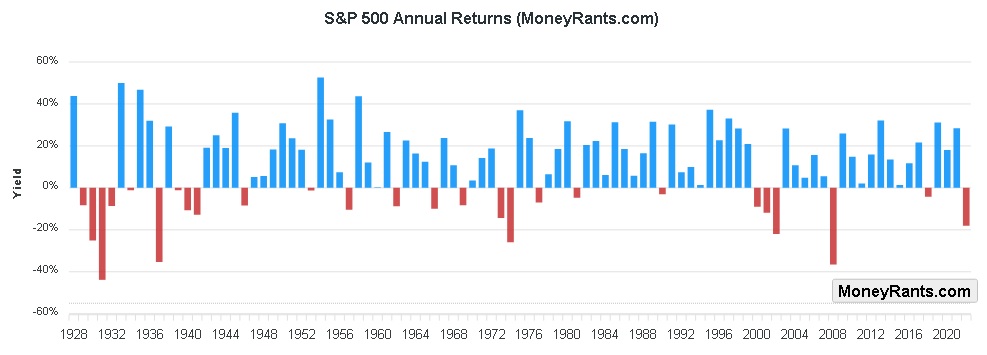

The S&P 500 Price index returned -19.64% in 2022. When dividends are counted, the return would be -18.32%. The dividends generate additional returns which are not included in the initial price return calculation. This is known as the total return and it is a more comprehensive measure of an investment’s performance as it includes both price changes and dividends.

The Dow Jones Industrial Average (DJIA) performed better than the S&P 500, with a return of -6.9%. The Russell 2000, which focuses on smaller companies, performed worse with a total return of -20.4%.

2022 was a challenging year for many U.S. companies as inflation soared, reaching a peak of 9.1% year over year in June. The Federal Reserve responded by rapidly increasing interest rates in an effort to combat high prices. This had a negative impact on many companies, especially those with high levels of debt. Higher interest rates increase the cost of borrowing for companies, which can negatively impact profits and stock prices. Additionally, the increase in inflation can also lead to higher production costs and reduce consumer purchasing power, which can negatively impact sales and profits.

S&P 500 Performance By Sector

In 2022, the energy sector was the best performing sector of the S&P 500 with a return of 65.7%. This was likely due to a combination of factors such as an increase in oil prices, strong demand for energy, and favorable regulatory changes. The S&P 500 Utilities index was the only other sector that closed the year with a positive return of 1.6%.

On the other hand, the S&P 500 Communication Services index had the worst return in 2022 of the group, at negative 39.9%. The S&P 500 Consumer Discretionary index followed closely behind with a return of negative 37.0%.

Leave a Reply

You must be logged in to post a comment.