- This week, the Federal Reserve is set to cut interest rates by a quarter point, following confirmation of a slowing labor market and a bond market that has pushed long-term yields back to 4%.

- Meanwhile, Trump’s foreign policy is showing its fragility in Europe. Europe faces the risk of direct conflict with Russia. The incursion of Russian military drones into Poland has reignited tensions, underscoring the weakness of American diplomacy. In France, President Macron is attempting to form a new government under Prime Minister Sébastien Lecornu.

- The euro has pulled back slightly from recent highs on geopolitical tensions, but narrowing rate differentials with the U.S. are keeping the single currency close to key resistance levels against the dollar.

Fed Delivers a Late-Summer Rate Cut

Many analysts expect that the Fed’s anticipated rate cut this week could trigger a fresh wave of dollar weakness. The greenback remains overvalued.

A period of stalling in EUR/USD was to be expected. Factors now shaping the market include: overly bearish sentiment, an oversold dollar, convergence in growth prospects between the U.S. and other Western economies in the months ahead, and a bond yield gap that is set to narrow, making Treasuries less attractive.

Strategically, the case for a long euro remains intact, supported by higher real yields and expectations that the European Central Bank will soon halt its rate cuts.

In the U.S., a cooling labor market could ease wage pressures—and therefore inflation—giving Chair Jerome Powell room to cut borrowing costs in an effort to offset the drag from tariffs. In Europe, however, fears of a widening conflict with Russia are intensifying.

The incursion of Russian drones into Polish airspace has heightened the risk of a military accident along NATO’s borders. The alliance is bolstering its defenses. Washington’s silence is striking, while Europe’s political divisions—compounded by France’s instability—are deepening uncertainty. Macron, following the resignation of Prime Minister François Bayrou, tapped close ally Lecornu to lead a new government, though it is far from clear whether a stable parliamentary majority will back him. For now, speculation in French government bonds has not triggered panic, but Europe’s challenges are no longer purely economic—they are increasingly political.

Technical analysis: Despite all this, the euro is holding its ground.

Despite the string of market-moving events, volatility in EUR/USD has been steadily contracting. For several weeks, the distance between weekly highs and lows has narrowed.

Investors are waiting for the Fed’s policy signals, watching France’s political developments, and now bracing for how tensions with Russia evolve.

Yet uncertainty has not pushed investors toward the dollar. In our view, the U.S. currency is set to lose ground over the coming months once it works through the overbought conditions that drove the summer rally to a peak near 1.18.

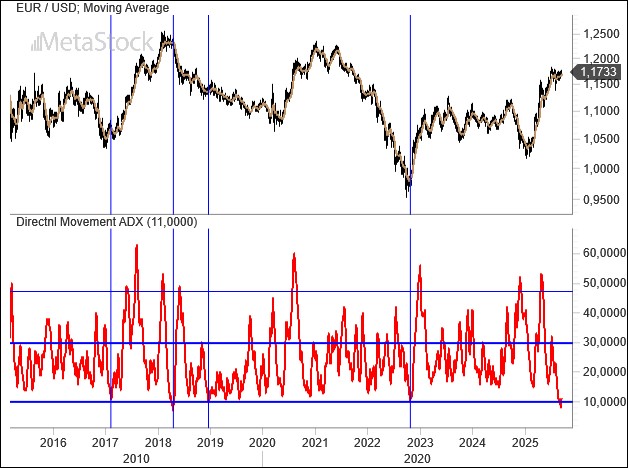

It doesn’t take much to see that EUR/USD has reached a turning point. The daily chart, paired with the ADX trend-strength indicator, shows as much.

With the ADX falling below 10—a level reached only a handful of times in the past decade—the exchange rate is in a state of complete indecision, with no clear trend. Statistically, the odds of a rise or a fall from here are evenly balanced, though conditions still look favorable to the upside.

Either way, volatility is on the verge of breaking out, offering opportunity for traders. Above 1.18, the long euro case becomes more compelling. Below 1.14, the short side is preferable.

Leave a Reply

You must be logged in to post a comment.