Author: Lila Harrington

-

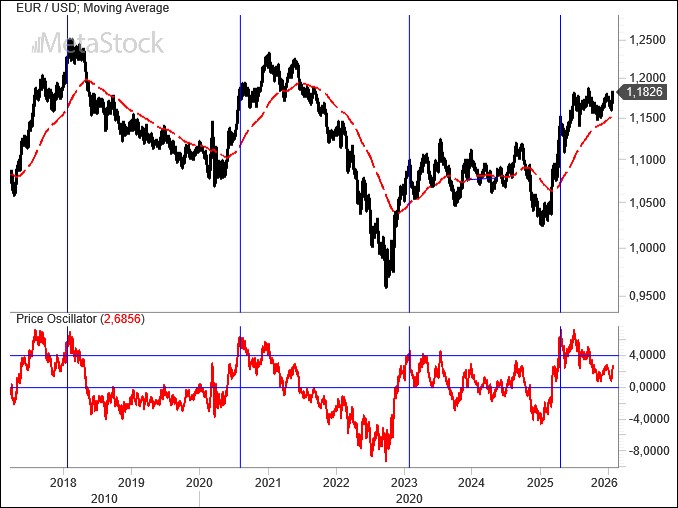

EUR/USD Weekly Outlook – February 16, 2026: Dollar Under Pressure, but Holding

The United States is in economic recovery, but job creation remains modest and heavily concentrated in a handful of sectors. That was the takeaway from the latest employment report, which nonetheless confirmed a decline in the unemployment rate. Inflation continues to ease. For EUR/USD, the latest attempt to break through the 1.19 resistance level appears…

-

EUR/USD Weekly Outlook, February 9, 2026: The Euro Struggles to Break Through

The United States continues to deliver very solid growth figures despite tariff policies and ongoing geopolitical uncertainty. Europe is also holding up well in this environment, with the ECB opting to keep interest rates unchanged at 2%. After its strong rally, EUR/USD has so far failed to break through the key resistance at 1.19, reinforcing…

-

EUR/USD Weekly Outlook, February 2, 2026: Trump Leaves the Dollar to Its Fate

The Federal Reserve has put monetary policy on hold for the time being, likely until late spring, when Jerome Powell’s term expires and the newly appointed Kevin Warsh is set to take over. Meanwhile, geopolitical and trade tensions are building, with Donald Trump once again at center stage. EUR/USD is emerging as a useful barometer…

-

EUR/USD Weekly Outlook, January 26 2026: Much Ado About Nothing

Trump attempted to recreate a “Liberation Day” moment for Europe, but failed in the face of a compact front, together with Canada, that ultimately forced him to abandon his expansionist ambitions in Greenland. Meanwhile, the search continues for a Federal Reserve candidate to replace Jerome Powell. The dollar is bearing the brunt of this uncertainty,…

-

EUR/USD Weekly Outlook – January 19, 2026: Global Disorder

Geopolitical tensions remain elevated. After Venezuela, Iran’s regime now appears to be the next target of the Trump administration, as popular uprisings are driving tensions higher across the Middle East. These developments are compounded by renewed frictions with Europe linked to Greenland. Meanwhile, U.S. inflation data confirm that consumer prices continue to follow a downward…

-

EUR/USD Weekly Outlook, January 12, 2026: Geopolitics Take Center Stage as the Euro Stalls

Trump continues to dominate media attention following the removal of Venezuela’s president. Rhetoric is intensifying not only in Washington’s confrontations with China and Russia, but also with Europe, given Trump’s renewed interest in Greenland. South America, meanwhile, is increasingly portrayed as a new frontier for U.S. influence. Data on both sides of the Atlantic confirm…

-

EUR/USD Weekly Outlook, January 5, 2026: Is Another Year of Dollar Weakness Ahead?

With an especially negative 2025 now behind it, the U.S. dollar is beginning to face the first 2026 outlooks from major investment houses, many of which highlight a series of challenging factors ahead for the greenback. Beyond pure price-based technical analysis, pivotal events such as the U.S. midterm elections and a change in leadership at…

-

EUR/USD Weekly Outlook, December 22: The World According to Trump

The U.S. economy failed to generate jobs in the past quarter, a consequence of the government shutdown and, likely, of consumers becoming more cautious as inflation struggles to ease. Trump has sought to reassure the country by placing confidence in the future Federal Reserve chair, who is expected to lower interest rates. The dollar, meanwhile,…

-

EUR/USD Weekly Outlook, December 15: Geopolitics Back in the Driver’s Seat

The Federal Reserve cut rates by 25 basis points as expected, bringing them into the 3.5%–3.75% range, while striking a cautious tone on its next moves. At the same time, tensions are rising between President Trump and European leaders over Ukraine, with the tycoon increasingly aligned with Russian positions and eager to seal a deal…

-

EUR/USD Weekly Outlook, December 8: Markets Edge Higher as Fed Cut Looms

Markets are entering the Federal Reserve meeting with only modest volatility, given an outcome that appears all but certain. What remains unclear is whether December’s rate cut will be followed by additional easing moves, especially with macro data that doesn’t seem to justify further intervention. In the meantime, the dollar continues to lose ground, slipping…